Cialis ist bekannt für seine lange Wirkdauer von bis zu 36 Stunden. Dadurch unterscheidet es sich deutlich von Viagra. Viele Schweizer vergleichen daher Preise und schauen nach Angeboten unter dem Begriff cialis generika schweiz, da Generika erschwinglicher sind.

Hbhf_02_237633.dvi

Affect and Financial Decision-Making: How Neuroscience Can

Inform Market Participants

QUERY SHEET

Q1: Au: Please add Reference (from page 10

The Journal of Behavioral Finance

2007, Vol. 8, No. 2, 1–9

The Institute of Behavioral Finance

Affect and Financial Decision-Making: How Neuroscience Can

Inform Market Participants

Richard L. Peterson, M.D.

We review recent neuroscience literature on the influences of moods, attitudes, andemotions (affects) on financial decision-making. Evidence indicates the existence of

separate brain systems, linked to affect processing, that are responsible for risk-takingand risk-avoiding behaviors in financial settings. Excessive activation or suppressionof either system can lead to errors in investment choices and trading behaviors. Wesuggest ways for market participants to become aware of the potential impact ofaffect on their behavior in order to avoid suboptimal financial decisions. This paper

has two overall aims: to educate financial practitioners about the origins of emotionsthat can adversely impact their performance, and to teach investors how to makebetter financial decisions.

keywords: Affect, Finance, Markets, Neuroscience, Decision

represent small expected losses. To explain further, weoffer an explanation derived from understanding the

Recent financial research has shown that individual

brain's affective and motivational circuits.

investors systematically deviate from optimal trading

Affect is defined as the subjective and immediate

behavior (Daniel, Hirshleifer, and Teoh [2002],

experience of emotion attached to ideas or objects

Hirshleifer [2001], Odean and Barber [1998]). Some

(Sadock [2000]). Affect often has outward manifesta-

authors hypothesize that affect (emotions, moods,

tions, such as altering normal facial expressions, vocal

feelings, and attitudes) plays a prominent role in

tones, and physical posture. Positive affect indicates

financial decision making (see Lo and Repin [2002]

optimism, and the evaluation of a decision based on

and Lucey and Dowling [2005] for an excellent

potential gain. Positive affect motivates us to continue

review). However, the mechanisms by which affect

pursuing a course of action. Negative affect indicates

influences choice remain unclear.1

pessimism, and the evaluation of a decision based on

In this paper, we review the finance literature and

potential loss. Negative affect motivates us to avoid

assemble evidence that affect states influence both in-

activities or situations that prompt it.

vestor behavior and market prices. Using recent find-

Affect states give rise to characteristic cognitive and

ings from neuroscience, we describe the neurological

behavioral tendencies. Risk-related biases in financial

basis of affective influences on financial decisions. In

judgment have been associated with affect and named

light of these new findings, we instruct readers how

the "affect heuristic" (Slovic et al. [2002], Finucane,

to manage disruptive affects as they arise in order to

Peters, and Slovic [2003]).

improve the quality of their financial choices.

Since Aristotle, scientists and philosophers have

To begin, consider the following paradox: Why do

loosely hypothesized that two major brain functions

people buy both insurance and lottery tickets? Insur-

are fundamental to almost all human behavior:

reward

ance, which insulates us from unanticipated financial

approach (pleasure-seeking), and

loss avoidance (pain

losses, is an investment with negative expected returns.

avoidance) (Spencer [1880]). These systems can be

Buying lottery tickets is a gambling behavior that im-

activated or deactivated independently. When we face

plies the acceptance of a negative expected return in

potential financial gains or losses, one or both of these

the attempt to earn a larger gain. Ironically, we buy

systems may be used in decision making.

insurance to avoid potential losses, and we buy lottery

Neuroscience helps us understand the character-

tickets to pursue potential gains, yet both purchases

istics of these motivational systems and their conse-

quences for our behavior. We review recent empirical

Richard L. Peterson, M.D. is a Managing Partner in Market

evidence that shows the direct link between brain ac-

Psychology Consulting Fairfax, California.

tivation specific to these systems, affective states, and

The corresponding author is Richard L. Peterson, Managing Part-

financial decision making.

ner Market Psychology Consulting, 399 Forrest Ave Fairfax, CA

The paper is organized as follows. The second sec-

94930 415.267.4880. Email:

[email protected] Microsoft Word

tion discusses the components of the reward and loss

avoidance systems and defines affective states. The

and pursuit. People who are electrically stimulated in

third and fourth sections survey empirical findings on

brain regions with high concentrations of dopamine

the role of affect in financial markets and on trading be-

terminals report intense feelings of well-being (Heath

havior. The fifth section discusses some of the personal

[1964]). In fact, the dopaminergic pathways of the re-

consequences of pathological disruptions in the func-

ward system are activated by illicit drug use, hence the 110

tionality of these systems. The sixth section discusses

term "dope" to refer to street drugs. Dopamine activity

the neurochemistry and genetics of risk assessment.

in the reward system appears to correlate with subjec-

The final section concludes, and proposes ways indi-

tive reports of positive affect (Knutson [2001b]).

viduals can make better financial choices by taking into

The personality trait of extraversion is character-

account the impact of affect on their decision making.

ized by both reward-seeking and sociability (gregari- 115ousness). Neuroscience researchers like Cohen et al.

[2005] have found that activation of the brain's re-

Reward and Loss Avoidance Systems in

ward system is positively correlated with extraversion

Decisions under Risk

scores. Cohen et al. [2005] also found that the pres-ence of the dopamine D2 receptor A1 allele correlates 120

Perceiving a potential reward in the environment

with extraversion and the strength of reward system

sets the brain's reward approach system into action.

activation when receiving financial rewards.

Overall, the reward system coordinates the search for,

The brain's loss avoidance system is less defined

evaluation of, and motivated pursuit of potential re-

than the reward system. It runs through several regions

wards. The neurons that carry information in the reward

of the brain's limbic system, in particular the amyg- 125

system transmit signals primarily via the neurotrans-

dala and the anterior insula. Its activity is mediated

mitter dopamine. The reward system lies along one

by serotonin and norepinephrine (among other neuro-

of the five major dopamine pathways in the brain, the

transmitters), and can be modulated with antidepres-

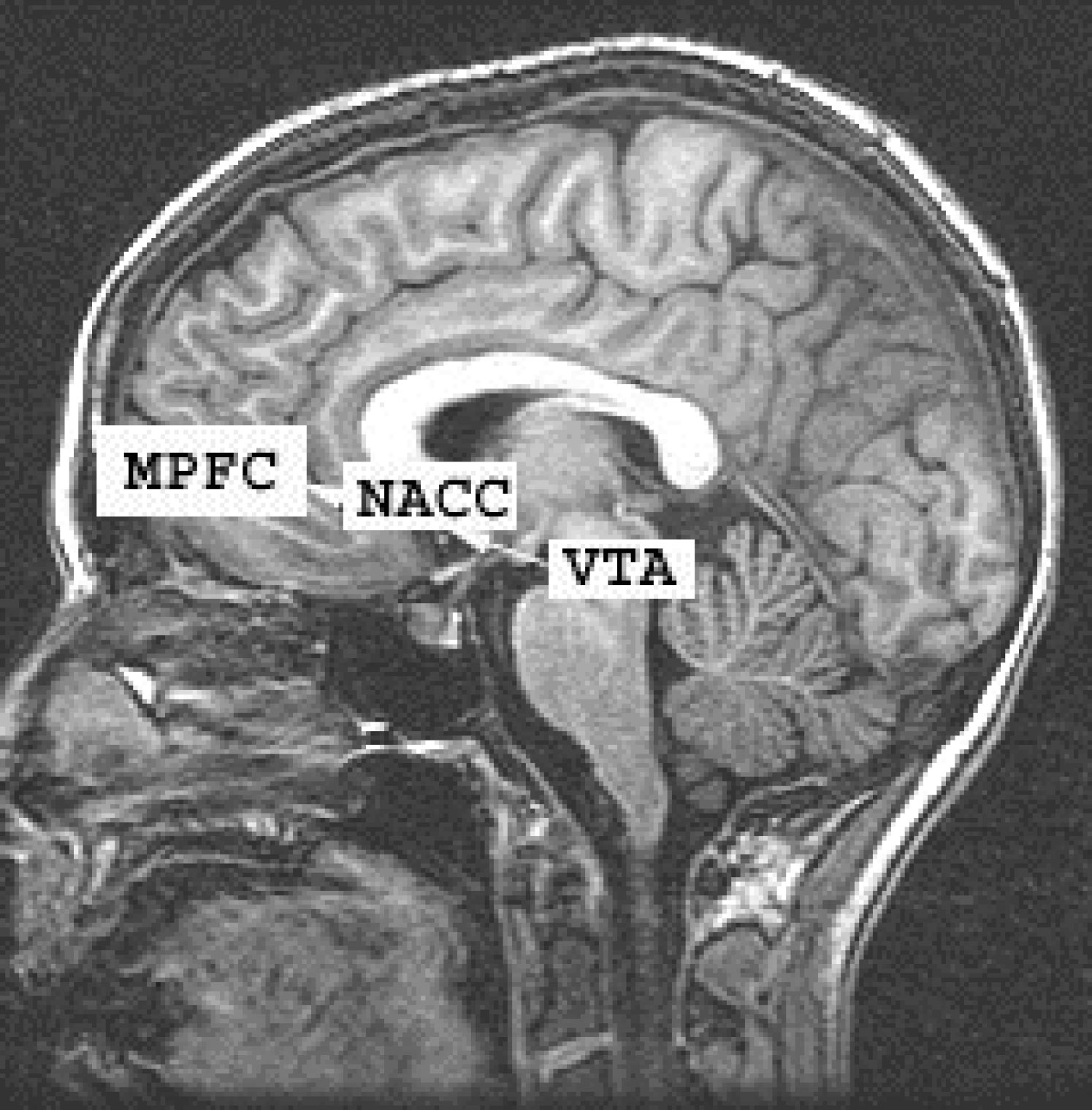

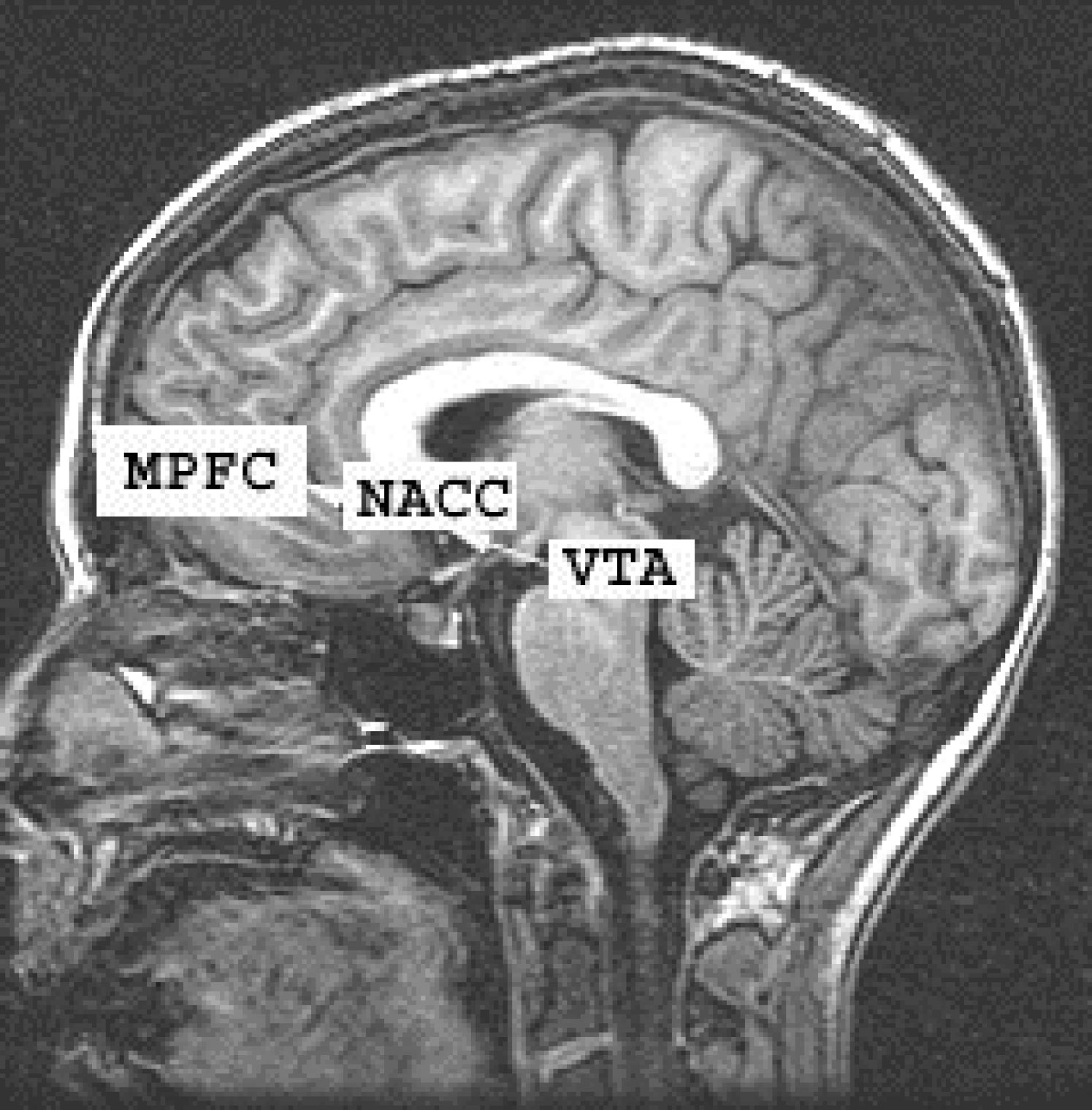

mesolimbic pathway, which extends from the ventral

sant medication such as selective serotonin reuptake

tegmental area (VTA) at the base of the brain, through

inhibitors (SSRIs). Acute activation of the loss avoid- 130

the nucleus accumbens (NAcc) in the limbic system, to

ance system can lead to the subjective experience and

the gray matter of the frontal lobes (MPFC) (Bozarth

physiological signs of anxiety (Bechara, Damasio, and

[1994]) (see Figure 1).

Damasio [2000]).

Dopamine has historically been called the "plea-

Chronic activation of the loss avoidance system is

sure" chemical of the brain. More recently, dopamine

indicated by the personality trait of neuroticism (Floury 135

has been found to play a part in functions such as atten-

et al. [2004]), which is characterized by risk aversion.

tion, mood, learning, motivation, and reward valuation

The prevalence of neuroticism has been weakly asso-ciated with the short form ("s"-allele) of the serotonin

transporter gene, which leads to a decrease in serotonin

The Major Structural Components of the Reward

sensitivity (Arnold, Zai, and Richter [2004]).

System. The dopamine neuron cell bodies located

Amygdala activation appears to decrease when po-

in the ventral tegmental area (VTA) have axonal

tential rewards are missed, showing an inverse corre-

extensions through the nucleus accumbens (NAcc)

lation with punishment. The brain's insula is involved

and into the frontal lobes, including the medial

in the anticipation of aversive affective and noxious

prefrontal cortex (MPFC).

physical stimuli (Simmons et al. [2004]) and in selec- 145tive disgust processing (Wright et al. [2004]). Pauluset al. [2003] show that insula activation is related torisk-averse decision making. They found that 1) insulaactivation was significantly stronger when subjects se-lected a "risky" response versus a "safe" response in 150an experimental task, 2) the degree of insula activa-tion was related to the probability of selecting a "safe"response following a punished response, and 3) thedegree of insula activation was related to subjects' de-gree of harm avoidance and neuroticism as measured 155by personality questionnaires.

Kuhnen and Knutson [2005] have demonstrated

the roles of the reward and loss avoidance systemsin portfolio choice and investment error. Their goalswere to determine whether anticipatory brain activity 160in the NAcc and anterior insula would predict risk-seeking versus risk-averse choices, and whether acti-

AFFECT AND FINANCIAL DECISION-MAKING

vating these regions would influence both suboptimal

thus collectively increase their willingness to accept

and optimal choices.

risk.Kamstra, Kramer, and Levi [2001] find that stock

Kuhnen and Knutson's [2005] study combined a

returns are significantly related to season. They ex-

dynamic investment task with functional magnetic res-

amine stock returns during the three months between 220

onance imaging (fMRI). Subjects' actual investment

the fall equinox and the winter solstice, and the three

choices during the task were compared to those of a

months between the winter solstice and the spring

rational risk-neutral agent who maximized expected

equinox. The authors found that variations in the length

profit. Suboptimal choices were defined as deviations

of day contribute to stock returns. In particular, the

from this model, and included both "risk-seeking mis-

market underperformed in the fall quarter and outper- 225

takes" (in which people take risks when they should

formed in the spring quarter. They hypothesize that

not), and "risk-aversion mistakes" (in which people do

affective shifts, like the seasonal mood variations of

not take risks when they should).

seasonal affective disorder, can alter risk preferences

Kuhnen and Knutson [2005] found that while NAcc

and subsequent investment behavior.

activation preceded both risky choices and risk-seeking

Krivelyova and Robotti [2003] found correlations 230

mistakes, anterior insula activation preceded both risk-

between strong geomagnetic storms and world stock

less choices and risk aversion mistakes. These findings

market underperformance over the following six days.

are consistent with the hypotheses that NAcc activation

The authors noted that the psychology literature

represents gain prediction (Knutson et al. [2001b]),

also demonstrates a correlation between geomagnetic

while anterior insula activation represents loss predic-

storms and signs of depression in the general popula- 235

tion (Paulus et al. [2003]). The results indicate that

tion over the two weeks following the storms. Depres-

anticipatory neural activation contributes to rational

sion is an affective disorder characterized, in part, by

choice and may also promote irrational choice. Thus,

risk aversion.

financial decision-making requires recruiting distinct

Seasonal and meteorological factors may contribute

anticipatory mechanisms for taking or avoiding risks,

to market price anomalies via collective changes in 240

while remembering that excessive activation of one

affect (and thus risk preferences). However, the nature

mechanism or the other may lead to mistakes.

of these effects is still debated. Goetzmann and Zhu

Overall, these findings suggest that risk-seeking

[2002] analyzed trading accounts of 79,995 investors

choices (such as gambling at a casino) and risk-averse

from 1991 to 1996, and found that individual investors

choices (such as buying insurance) may be driven by

do not trade differently on sunny days versus cloudy 245

two distinct neural mechanisms involving the NAcc

days. However, the authors did note that market maker

and the anterior insula. The findings are consistent

behavior was significantly impacted by the degree of

with the notion that activation in the NAcc and the

cloud cover. Wider bid/ask spreads on cloudy days

anterior insula relate to positive and negative antici-

were hypothesized to represent risk aversion among

patory affective states, respectively. Activating one of

market makers.

these regions can lead to a shift in risk preferences. This

If affect states do predict market price movements,

may explain why casinos surround their guests with re-

how can we measure investors' average affect in order

ward cues (i.e., inexpensive food, free liquor, surprise

to predict market prices? In the finance literature, senti-

gifts, potential jackpot prizes). Anticipating rewards

ment is the closest available measure. Both newsletter

activates the NAcc, which may lead to an increase in

writers (Clarke and Statman [1998]) and individual 255

investors (Fisher and Statman [2000]) show increasedoptimism about future stock market gains (bullishness)following high recent returns. Additionally, Fisher and

Affect in Market Pricing

Statman [2000] found that as the S&P 500 declinedover a twelve-month period, investor optimism about 260

Over the past five years, several finance studies have

the stock market's future also declined.

directly identified affective factors as likely causes of

Fisher and Statman [2000] noted that the percent-

market price anomalies. Cloud cover, for example,

age of investors who believed the market was over-

has been used as a proxy for negative affect states

valued was paradoxically correlated with expectations

(Schwartz [1983]). Hirshleifer and Shumway [2002]

of future returns from 1998 to 2001. When investors 265

found that cloud cover in the city of a country's major

perceived the market as undervalued, they expected to

stock exchange was negatively correlated with daily

earn lower returns. As sentiment became more opti-

stock index returns in eighteen of twenty-six national

mistic or pessimistic in a positive feedback relation-

exchanges from 1982–1997. In New York City, there

ship with past price changes, so did expectations of

was a 24.8% annual return for all sunny days, and

future gains or losses. Additionally, sentiment levels 270

an 8.7% average return for cloudy days. The authors

appear to be negatively correlated with (and somewhat

cite psychology literature indicating that sunshine in-

predictive of) future market price changes (Fisher and

creases market participants' positive affect, and may

Statman [2001]).

Whether sentiment is a proxy for the activation of

emotionally stable, introverted, and open to new ex-

the reward system (bullishness) or the loss avoidance

system (bearishness) remains unknown. Positive feel-

Steenbarger [2003] performed personality tests on 330

ings (like optimism) are a proxy for reward system

sixty-four traders at a seminar conducted by "Market

activation, and it is very likely that the brain's moti-

Wizard" Linda Bradford Raschke. He found that high

vational systems are engaged when forecasting future

conscientiousness scores (a measure of impulse con-

stock market gains or losses.

trol) were the most reliable predictor of trading success,but that high openness and high neuroticism were cor- 335related with trading problems. He summarizes these

Emotions and Personality in the Trading Pit

findings as "one important lesson: Success in tradingis related to the ability to stay consistent and plan-

Several researchers have investigated the psycho-

driven." Emotional stability and impulse control tend

logical origins of successful and unsuccessful trading.

to correlate with successful trading.

Quantifiable differences have been found between the

personality traits and emotional reactions of successfulversus less successful traders. Personality traits rep-

Financial Decisions and Mental Health

resent affective coping and impulse control strategiesthat differ from individual to individual. We previously

The neural origins of financial risk-taking can

discussed the personality trait neuroticism as a func-

be partially understood by examining the underlying

tion of the loss avoidance system. The personality trait

pathologies and treatments of individuals who exhibit

extraversion is correlated with optimism, an affect as-

disordered financial behavior. Some mental illnesses, 345

sociated with reward system activation. Preliminary

as defined by the Diagnostic and Statistical Manual

neuroscience evidence has suggested that extraverts

IV-TR (American Psychiatric Association [2000]), re-

have more sensitive reward systems during financial

sult in abnormal financial behavior. Brain lesions in the

gain processing (Cohen et al. [2005]).

orbitofrontal cortex, a processing center of the reward

Lo and Repin [2002] took psychophysiological

system, have been found to result in specific abnor- 350

measurements from ten traders during real-time intra-

malities in financial decision making (Damasio [1994],

day trading and found that traders experienced physi-

Shiv et al. [2005]). Taken together, these findings shed

ological reactions during periods of market volatility.

some light on the fundamental mechanisms of financial

They also showed that less experienced traders had

decision making.

significantly greater physiological reactions to mar-

Acute mania is a pathological mood state typically 355

ket volatility than their more experienced colleagues.

characterized by euphoric mood and excessive risk-

The authors concluded, "Contrary to the common be-

taking (including with money). Some manic patients

lief that emotions have no place in rational financial

who have access to brokerage accounts will rapidly

decision-making processes, physiological variables as-

trade stocks, often until the account is drained. One

sociated with the autonomic nervous system are highly

website notes that some manic patients "go on shop- 360

correlated with market events even for highly experi-

ping sprees, spend food money to buy lotto tickets, or

enced professional traders."

try to make a killing in the stock market" (Bernhardt

In a subsequent study, Lo, Repin, and Steenbarger

[2005] examined the trading patterns, personality char-

Mania is caused by overactive dopaminergic cir-

acteristics, and daily affective reactions of eighty

cuits in the brain, including the mesolimbic circuit of 365

traders over twenty-five trading days. Only thirty-three

the reward system. Treatments for mania include an-

of the traders completed the study, in part because of

tipsychotic medications that directly block or limit the

a 20% market decline during the study period. The au-

neural stimulation caused by dopamine release. But

thors concluded that personality traits themselves are

these treatments are often rejected by patients because

not important for trading. However, they did find a cor-

they also dampen the euphoric high that accompanies 370

relation between the strength of affective reactions and

an acute manic episode.

poor trading performance. They conclude, "Our results

For another example, consider that the lifetime

show that extreme emotional responses are apparently

prevalence of pathological gambling disorder in the

counterproductive from the perspective of trading per-

U.S. is less than 3.5% (American Psychiatric Associa-

tion [2000]). Recent neuroimaging studies demonstrate 375

The big five personality traits – extraversion, consci-

a hypoactivity of the reward circuitry in these individu-

entiousness, neuroticism, openness, and agreeableness

als. Pathological gamblers often gamble to "feel excite-

– are directly related to styles of affective processing

ment," which they achieve by activating their patholog-

and impulse control. Fenton-O'Creevy et al. [2004]

ically desensitized reward circuits.

conclude from a study of 118 professional traders at

Pathological gambling is often treated with naltrex- 380

investment banks that successful traders tend to be

one (Kim et al. [2001]), a medicine that blocks opiate

AFFECT AND FINANCIAL DECISION-MAKING

receptors. In the reward system, mu opiate receptors

have shown success in treating hoarding (Saxena and

stimulate dopamine release (Di Chiara and Imperato

Maidment [2004]).

[1988]). Blocking opiate receptors with naltrexone de-

creases dopamine release in the nucleus accumbens,which results in decreased subjective feelings of plea-

The Neurochemistry of Risk Assessment

sure (Jayaram-Lindstrom et al. [2004]). Gamblers tak-ing naltrexone are not compelled to seek reward sys-

An article written by a psychiatrist in February

tem stimulation through further gambling, possibly be-

2000 was headlined "Is the Market on Prozac?" (Nesse

cause they feel reduced pleasure from gambling.

[2000]). The article noted that prescriptions for psy-

Some subtypes of depression, such as "melan-

choactive drugs increased from 131 million in 1988 to 445

cholic" depression, correlate with decreased dopamine

233 million in 1998. The author went on to speculate,

activity in the reward pathway. Melancholic depression

"I would not be surprised to learn that one in four large

also correlates with anhedonia (lack of pleasure), ex-

investors has used some kind of mood-altering drug."

cessive sleepiness, and chronic risk aversion, including

He also remarked that some of his patients on SSRI

in the financial markets.

medications "report that they become far less cautious 450

One patient in treatment with this author for depres-

than they were before, worrying too little about real

sion kept all her assets in cash. Because of her fear of

dangers." He wondered whether the clear disregard

financial risk, she was reluctant to invest in U.S. gov-

for risk among many investors at that time was partly

ernment bonds because she believed the government

attributable to the use of common antidepressant med-

might default on payments. These thought distortions

were directly related to her depressive illness and its

In fact, many executives are rumored to refer to

neurochemical basis. Successful treatment with antide-

Prozac as the "teflon-medicine," because it allows them

pressant medications was followed by small, tentative

to look past perceived threats, decide quickly without

purchases of bonds and mutual funds.

ruminating, and remain more optimistic during stress.

The role of anxiety in biasing financial decisions is

In his bestselling book, Listening to Prozac, psychia- 460

less clear-cut than for mania, pathological gambling,

trist Peter Kramer [1993] frets about the potential use

and depression. Pathological anxiety is characterized

of SSRI antidepressants as "steroids for the business

by exaggerated risk perception and hypervigilance. At

higher levels, anxiety may lead to panic and the psy-

Knutson et al. [1998] gave normal subjects ther-

chophysiological "fight or flight" response (e.g., "panic

apeutic doses of the antidepressant paroxetine (an 465

selling"). Whether the "fight" or the "flight" response

SSRI). Knutson's subjects experienced a reduction in

is triggered depends on past experiences, personality

threat perception and an increase in affiliative behav-

traits, anxiety intensity, and learned coping strategies.

iors. In another study, subjects given the SSRI med-

Isolated mild anxiety leads to an overall reduction in

ication citalopram showed decreased amygdala (fear-

related) activations on fMRI (Del-Ben et al. [2005]). 470

Anxiety can lead to either impulsive overtrading, or

The characteristics of decreased threat perception and

paralysis and avoidance of the markets. If the reward

increased social affiliation mirror the decreased risk

system is overactivated along with the loss avoidance

perception and herding of excessively bullish investors.

system, obsessive overtrading may result. If the re-

It is as if bubble investors are experiencing a partial de-

ward system is underactivated, paralysis and passive

activation of their brains' loss avoidance systems.

anxiety may occur. Mild anxiety and neuroticism cor-

In addition, amphetamines are known to increase

relate with a paucity of serotonin function throughout

the brain's extracellular concentration of dopamine.

the brain (Floury et al. [2004]). These disorders are

Neuroimaging data collected by Knutson et al. [2004]

often successfully reversed with serotonin-enhancing

suggest that amphetamines modulate dopamine sig-

medications like fluoxetine (Prozac).

nals in the NAcc area of the reward system. Anec- 480

Two mental disorders on the obsessive-compulsive

dotal reports indicate that time-release amphetamine-

spectrum merit discussion as well. First, compulsive

derived medications have been used by poker play-

shopping disorder is currently assumed to reside on

ers to win millions of dollars in tournaments. "With

the obsessive-compulsive/anxiety spectrum of disor-

Adderall [an amphetamine derivative] in my system, I

ders, but its legitimacy as an independent mental ill-

am like an information sponge, able to process data 485

ness is still being debated. Moderately successful treat-

from several players at once while considering my

ment has been achieved with the SSRI antidepressant

next action" (Phillips [2005]). The author speculates

(citalopram) (Bullock and Koran [2003]). Second, the

that the increased focus and wakefulness promoted by

disorder of hoarding, whereby sufferers accumulate ex-

amphetamines aids poker playing.

cessive quantities of one type of good or asset, is also

Some medications directly alter risk/return percep- 490

considered a subtype of obsessive-compulsive disor-

tions in behavioral experiments. Rogers et al. [2004]

der. Only behavioral and psychotherapy approaches

report that a common high blood pressure medication

in the beta-blocker family decreased experimental sub-

(Goleman [1998]). For example, according to Schwa-

jects' discrimination of potential losses during a risky

ger [2003], Steve Cohen, the principal of SAC Capital,

task. "Propranolol [a beta-blocker] produced a selec-

is "unquestionably one of the world's greatest traders."

tive change in volunteers' decision-making; namely, it

SAC Capital has a former Olympic psychiatrist, Ari

significantly reduced the discrimination between large

Kiev, M.D., on staff to assist traders in improving 550

and small possible losses when the probability of win-

performance. The use of a psychiatrist by one of the

ning was relatively low and the probability of losing

world's greatest traders certainly supports the notion

was high" (Rogers et al. [2004]). Propranolol is also

that psychological management can benefit financial

one of the most common treatments for "stage fright,"

risk-takers. It may even suggest that people need psy-

and is occasionally used to treat other types of anxiety

chological support to prevent themselves from suc- 555

and aggressive impulsivity.

cumbing to the most common cognitive, behavioral,

Perhaps not surprisingly, other drugs have also been

and affective biases.

shown to affect financial decisions. Lane et al. [2005a]

While observing Steve Cohen trade, Schwager

designed an experiment in which subjects were given

[2003] is "struck by his casualness." Schwager notes,

a choice between a certain low-value positive expected

"He also seemed to maintain a constant sense of humor 560

value option ($0.01) or a zero expected value option

while trading." Cohen's sense of humor and casualness

with high return variability (the risky option). THC-

demonstrate that he isn't taking his trading gains and

intoxicated subjects preferred the risky option signifi-

losses "to heart." So how can the average financial de-

cantly more than control subjects who had been given

cision maker maintain such an emotional balance and

a placebo. Additionally, if they lost money after select-

healthy state of mind?

ing the risky option, THC-intoxicated subjects were

One method of cultivating dispassion about finan-

significantly more likely to persist with it, while con-

cial performance is to maintain non-judgmental beliefs

trol subjects were more likely to move to the positive

and flexible expectations. In particular, practitioners

expected value option.

must realize that not every decision requires abso-

Lane et al. [2004] found a similar preference and

lute perfection or they will invariably be disappointed. 570

persistence with the risky option in alcohol-intoxicated

George Soros [1995] provides an excellent example.

subjects when compared to controls. Deakin et al.

Referring to his well-publicized philosophy, "belief in

[2004] showed that a dose of the benzodiazepine val-

fallibility," he says, "To others, being wrong is a source

ium increased the number of points wagered in a risk-

of shame. To me, recognizing my mistakes is a source

taking task in only those trials with the lowest odds of

of pride. Once we realize that imperfect understand- 575

winning but the highest potential payoff. Lane et al.

ing is the human condition, there's no shame in being

[2005b] found that administration of the benzodi-

wrong, only in failing to correct our mistakes."

azepine alprazolam produced increased selection of a

Soros is thus protected from a crisis of confidence.

risky option under laboratory conditions. The strength

For most people, the possibility of being wrong is

of subjects' risk-seeking personality traits may be pre-

threatening and can cause anxiety. As Cymbalista 580

dictive of how drugs affect their risk-taking behavior

[2003] notes, "The difference between Soros and most

(Lane et al. [2005b]).

other traders is that he accepts fallibility, so he starts

These studies illustrate that common chemical

out by assuming his hypothesis is wrong, rather than

compounds can alter an individual's propensity for

right like almost everyone else." By maintaining a be-

risk. In particular, frequently prescribed antidepres-

lief in fallibility, Soros remains open-minded about his 585

sants and anxiolytics (SSRI medications) appear to

positions, and can minimize denial, disappointment,

decrease threat perception and increase social affili-

and anger if he learns his decisions were wrong.

ation. Time-release amphetamines increase alertnessand smooth the reward system's reactivity to potential

Investor, Heal Thyself

financial gains. A common hypotensive medication (abeta-blocker) decreased aversion to potential financial

Financial practitioners can improve their financial

losses. Findings regarding alcohol, marijuana, and ben-

decision making by learning to interpret and man- 590

zodiazepines suggest these drugs increase risky finan-

age affect states. With adequate self-awareness, affect

states can be viewed as internal signals. As seen fromthe examples we cite here, investors are most likely tomake subpar financial decisions if they are emotion-ally reactive or have poor impulse control. In either 595

How to Make Better Financial Choices

case, a dysfunction of the reward or loss avoidance sys-tems is likely to result. The affect states that can arise

are conditioned by our past experiences, the vividness

The use of psychological techniques to improve per-

of the potential consequences, innate genetic endow-

formance in the business world is increasing rapidly

ments, and personality (among many other factors). As 600

AFFECT AND FINANCIAL DECISION-MAKING

demonstrated in Kuhnen and Knutson [2005], strong

Additionally, note that successful financial practi-

affects threaten to override rational decision making

tioners systematize as much of their decision-making

and should be appropriately managed for optimal per-

as possible. Professionals are prepared for contingen- 660

cies, and they approach mistakes with curiosity, rather

In clinical psychology, there are a plethora of strate-

than dread, fear, or denial. As Lo and Repin [2002] find,

gies for regulating affect states. Use of these strategies

experienced professionals are less reactive to market

may benefit financial practitioners who find themselves

volatility than novices, which may be due to a classical

overwhelmed by affect (fear, euphoria, greed, panic,

conditioning process or their internal beliefs.

etc. . ) during their investment decision-making.

The brain's two motivational systems evaluate po-

The first step in managing affects is to become aware

tential gains and losses independently. We are likely to

of them. Biais et al. [2000] found that "highly self-

experience relatively strong affects when one system is

monitoring" traders perform better than their peers in

dominant and are prone to making irrational financial

an experimental market. While it is important to notice

decisions. Our only clue to a personal condition of im- 670

affect states, it is crucial to avoid placing any value

balanced motivational systems lies in our affect states.

judgment on them. Judgments such as "I shouldn't

If we learn to become self-aware, we can perceive when

be feeling this" or "I'm really good at this" interfere

one system is out of balance. Self-awareness, cultivat-

with the exercise and give rise to further affective reac-

ing a "belief in fallibility," exercising techniques of

tions (annoyance, disgust, anger, frustration, and self-

affect management, and visualizing and practicing dif- 675

congratulation, to name a few).

ficult decision situations can all assist in minimizing

Some common causes of affective reactions among

the irrational and costly impact of financial emotions.

financial decision makers include the size of the po-

We can take action and learn to be more profitable.

tential reward or loss (Knutson et al. [2001b]), thevividness of potential consequences (Loewenstein et al.

[2001]), and any counterfactual comparisons it rep-

resents (Mellers, Schwartz, and Ritov [1999]). Learnwhat financial situations cause affect to arise. Too of-

Based on the research we summarize here, it is ap- 680

ten, affect is left unnoticed and unattended. Place the

parent that recent financial gains and losses change

feelings in a context, and then practice noticing what

investor behavior. Financial market participants need

automatic behaviors you associate with them.

to monitor their own internal reactions to see how their

Meditation, peaceful reflection, and contemplation

decisions are biased by their recent experiences, and

are other disciplines that can be used to improve

they must be careful not to let such biases affect deci- 685

self-awareness. Financial practitioners should practice

sion discipline.

noticing the thoughts, feelings, and attitudes that un-

In particular, investors who have experienced a re-

derlie their decision-making. They can search for pat-

cent loss may note feelings of nervousness and/or other

terns, relationships, and emotionality, impulsivity, or

signs of irrational risk avoidance behavior like hesita-

irritability in these thoughts and feelings. In particular,

tion in entering new positions, excessive deliberation 690

when observing greed and fear, ask yourself: "What

about further potential losses, and seeing more finan-

causes this? Where did it come from? What is it re-

cial threats than usual. They must take special care not

lated to?" By placing the affective information in a

to let that anxiety affect future discipline in trading

personal context, you can become familiar with your

"triggers" and use awareness of your emotional state

Conversely, investors who have recently earned 695

to generate a personal warning signal. By understand-

large gains may be feeling celebratory, extremely intel-

ing and contextualizing your emotions, you can more

ligent, or somewhat invincible. They must also make

easily detect potentially weak decision situations when

sure not to focus solely on potential returns and ig-

nore the risk control and monitoring aspects required

Self-discipline, a facet of the personality trait con-

in making financial decisions.

scientiousness, relates to impulse management. It is es-

Not everyone can maintain a disciplined investment

sential to interrupting the automatic flow among emo-

strategy during the simultaneous gains or losses that ac-

tions, thoughts, and behaviors. Self-disciplined people

company stock market fluctuations. Our research sug-

are better able to control and channel their impulses

gests that investors' undisciplined decisions may be

toward goals. They can identify and delay acting upon

biased in a way that furthers the development of bull 705

their affects. To illustrate, we note that a survey of 600

and bear markets. When the stock market is rising and

foreign exchange traders in Europe and the U.K. by

most people are experiencing paper gains, many feel

Oberlechner [2004] asked traders to rank the most im-

hypomanic, they ignore risks, and they overempha-

portant characteristics for professional success. From a

size potential returns. Consequently, the market risk

list of twenty-three, "disciplined cooperation" ranked

premium tends to decline and stocks rise further, gen- 710

the highest.

erating more upward movements in the bull market.

When the stock market is falling and most peo-

in Male Volunteers." Psychopharmacology (Berlin), April, 173,

ple are incurring paper losses, many become anxious,

1–2, (2004) pp. 88–97.

place more emphasis on the risky attributes of stocks,

DeBondt, W., "Betting on Trends? Intuitive Forecasts of Finan-

cial Risk and Return." International Journal of Forecasting,

increase the risk premium they require to invest in

November, Vol. 9, No. 3, (1993) pp. 355–371.

stocks, and abstain from buying. This allows the de-

Del-Ben, C.M., J.F. Deakin, S. McKie, N.A. Delvai, S.R. Williams,

cline in stock prices to continue and a bear market to

R. Elliott, M. Dolan, and I.M. Anderson, "The Effect of Citalo- 780

pram Pretreatment on Neuronal Responses to Neuropsycholog-ical Tasks in Normal Volunteers: An fMRI Study." Neuropsy-

chopharmacology, April 13 (2005).

Di Chiara, G., and A. Imperato, "Opposite Effects of Mu and Kappa

Opiate Agonists on Dopamine Release in the Nucleus Accum- 785

Other research has examined the potential role of emotion

bens and in the Dorsal Caudate of Freely Moving Rats." Journal

in decision-making (Bernheim and Rangel [2004], Camerer,

of Pharmacology and Experimental Therapeutics, 244, (1988)

Loewenstein, and Prelec [2005], Loewenstein et al. [2001]).

pp. 1067–1080.

Also, economists have begun to incorporate emotion into mod-

Fenton-O'Creevy, M., N. Nicholson, E. Soane, and P. Willman,

els of individual choice (Bernheim and Rangel [2004], Caplin

Traders: Risks, Decisions, and Management in Financial Mar- 790

and Leahy [2001]). This research, however, did not focus on

kets. Oxford, UK: Oxford University Press (2004).

financial choices.

Finucane, M.L., E. Peters, and P. Slovic, "Judgment and Decision

Making: The Dance of Affect and Reason." In S.L. Schneider

and J. Shanteau, eds., Emerging Perspectives on Judgment andDecision Research. New York: Cambridge University Press, 795

American Psychiatric Association (APA). Diagnostic and Statisti-

(2003) pp. 327–364.

cal Manual of Mental Disorders, fourth edition, text revision

Fisher, K., and M. Statman, "Investor Sentiment and Stock Returns."

(DSM-IV-TR), Washington, DC. (2000).

Financial Analysts Journal, March/April, Vol. 56, No. 2, (2000)

Arnold, P.D., G. Zai, and M.A. Richter, "Genetics of Anxiety Dis-

orders." Current Psychiatry Reports, August, 6, 4, (2004) pp.

Fisher, K., and M. Statman, "Blowing Bubbles." Journal of Psychol- 800

ogy and Financial Markets, Vol. 3, No. 1, (2001) pp. 53–65.

Bechara, A., H. Damasio, and A.R. Damasio, "Emotion, Decision

Floury, J.D., S.B. Manuck, K.A. Matthews, and M.F. Muldoon,

Making and the Orbitofrontal Cortex." Cerebral Cortex, March,

"Serotonergic Function in the Central Nervous System is Asso-

10, 3, (2000) pp. 295–307.

ciated with Daily Ratings of Positive Mood." Psychiatry Res.,

Bernhardt, Stephen L., "Bipolar Disorder: Tempering the Mania

November 30, 129, 1, (2004) pp. 11–19.

of Manic Depression." http://www.have-a-heart.com/bipolar-

Goetzmann, W. and N. Zhu, "Rain or Shine: Where is the

depression.html, August 4 (2005).

Weather Effect?," Yale ICF Working Paper No:02–27, (2002)

Bernheim, D.B., and A. Rangel, "Addiction and Cue-Conditioned

Cognitive Processes." American Economic Review, 94, (2004)

Goleman, D., Working with Emotional Intelligence. London:

pp. 1558-1590.

Bloomsbury (1998).

Biais, B., D. Hilton, K. Mazurier, and S. Pouget, "Psychological

Heath, R.G., "Pleasure Response of Human Subjects to Direct Stim-

Traits and Trading Strategies." Unpublished manuscript (2000).

ulation of the Brain: Physiologic and Psychodynamic Consid-

Bozarth, M.A., "Pleasure Systems in the Brain." In D.M. Warburton,

erations." In R.G. Heath, ed., The Role of Pleasure in Human

ed., Pleasure: The Politics and the Reality. New York: John

Behavior. New York: Hoeber, (1964) pp. 219–243.

Wiley & Sons, (1994) pp. 5–14, references.

Hirshleifer, D., "Investor Psychology and Asset Pricing." Journal of 815

Bullock, K., and L. Koran, "Psychopharmacology of Compulsive

Finance, 56, (2001) pp. 1533–1597.

Buying." Drugs of Today (Barcelona), September, 39, 9, (2003)

Hirshleifer, D and T. Shumway, "Good Day Sunshine: Stock Returns

pp. 695–700.

and the Weather." Journal of Finance, June, (2002) pp. 1009–

Camerer, C., G.F. Loewenstein, and D. Prelec, "Neuroeconomics:

How Neuroscience Can Inform Economics." Journal of Eco-

Jayaram-Lindstrom, N., P. Wennberg, Y.L. Hurd, and J. Franck, 820

nomic Literature, 43 (2005).

"Effects of Naltrexone on the Subjective Response to

Caplin, A., and J. Leahy, "Psychological Expected Utility Theory

Amphetamine in Healthy Volunteers." Journal of Clinical

and Anticipatory Feelings." Quarterly Journal of Economics,

Psychopharmacology, December, 24, 6, (2004) pp. 665–

116, (2001) pp. 55–79.

Clarke, R., and M. Statman, "Bullish or Bearish?" Financial Analysts

Kahn, H., and C.L. Cooper, "How Foreign Exchange Dealers in the 825

Journal, May/June, Vol. 54, No. 6, (1998) pp. 63–72.

City of London Cope with Occupational Stress." International

Cohen and Ranganath [2004]. ).

Journal of Stress Management, 3, (1996) pp. 137–145.

Cohen, M.X., J. Young, J.M. Baek, C. Kessler, and C. Ranganath,

Kamstra, M., L. Kramer, and M. Levi, "Winter Blues: A SAD Stock

"Individual Differences in Extraversion and Dopamine Genet-

Market Cycle." American Economic Review, 1, (2001) pp. 324–

ics Predict Neural Reward Responses." Brain Res Cogn Brain

Res. November, 10 EPub (2005).

Kim, S.W., J.E. Grant, D.E. Adson, and Y.C. Shin, "Double-Blind

Cymbalista, F., "George Soros: How He Knows What He Knows,

Naltrexone and Placebo Comparison Study in the Treatment of

Part 1: The Belief in Fallibility." Stocks, Futures, and Options,

Pathological Gambling." Biological Psychiatry, June 1, 49, 11,

July, Vol. 2, No. 7, (2003).

(2001) pp. 914–921.

Damasio, A., Descartes' Error: Emotion, Reason, and the Human

Knutson, B., C.S. Adams, G.W. Fong, and D. Hommer, "Anticipa- 835

Brain. New York: Avon Books (1994).

tion of Monetary Reward Selectively Recruits Nucleus Accum-

Daniel, K., D. Hirshleifer, and S.H. Teoh, "Investor Psychology in

bens." Journal of Neuroscience, 21, RC159 (2001a).

Capital Markets: Evidence and Policy Implications." Journal of

Knutson, B., J.M. Bjork, G.W. Fong, D.W. Hommer, V.S. Mat-

Monetary Economics, 49, (2002) pp. 139–209.

tay, and D.R.R. Weinberger, "Amphetamine Modulates Hu-

Deakin, J.B., M.R. Aitken, J.H. Dowson, T.W. Robbins, and B.J.

man Incentive Processing." Neuron, 43, (2004) pp. 261– 840

Sahakian, "Diazepam Produces Disinhibitory Cognitive Effects

AFFECT AND FINANCIAL DECISION-MAKING

Knutson, B., G.W. Fong, C.S. Adams, and D. Hommer, "Dissociation

Paulus, M.P., C. Rogalsky, A. Simmons, J.S. Feinstein, and M.B.

of Reward Anticipation versus Outcome with Event-Related

Stein, "Increased Activation in the Right Insula During Risk-

FMRI." NeuroReport, 12, (2001b) pp. 3683–3687.

Taking Decision Making is Related to Harm Avoidance and

Knutson, B., O.M. Wolkowitz, S.W. Cole, T. Chan, E.A. Moore,

Neuroticism." Neuroimage, August, 19, 4, (2003) pp. 1439–

R.C. Johnson, J. Terpstra, R.S. Turner, and V.I. Reus, "Selective

Alteration of Personality and Social Behavior by Serotonergic

Phillips, P., "The 2005 World Series of Poker: How I Blew $350,000.

Intervention." American Journal of Psychiatry, 155, (1998) pp.

Plus: My Chemical Weapon, Modafinil." Slate.com, July 7

Kramer, P.D., Listening to Prozac: A Psychiatrist Explores Antide-

Reuter, J., T. Raedler, M. Rose, I. Hand, J. Glascher, and C. Buchel,

pressant Drugs and the Remaking of the Self. New York: Viking

"Pathological Gambling is Linked to Reduced Activation of the 910

Mesolimbic Reward System." Nature Neuroscience, February,

Krivelyova, A., and C. Robotti, "Playing the Field: Geomagnetic

8, 2, (2005) pp. 147–148.

Storms and International Stock Markets." Working paper, Fed-

Rogers, R.D., M. Lancaster, J. Wakeley, and Z. Bhagwagar, "Ef-

eral Reserve Bank of Atlanta (2003).

fects of Beta-Adrenoceptor Blockade on Components of Hu-

Kuhnen, C.M., and B. Knutson, "The Neural Basis of Financial

man Decision-Making." Psychopharmacology (Berlin), March, 915

Risk-Taking." Neuron, 47, (2005) pp. 763–770.

172, 2, (2004) pp. 157–164.

Lane, S.D., D.R. Cherek, C.J. Pietras, and O.V. Tcheremissine, "Al-

Sadock, B.J., "Signs and Symptoms in Psychiatry." In B.J. Sadock

cohol Effects on Human Risk Taking." Psychopharmacology

and V.A. Sadock, eds., Kaplan and Sadock's Comprehen-

(Berlin), February, 172, 1, (2004) pp. 68–77.

sive Textbook of Psychiatry, 7th ed. Philadelphia: Lippincott

Lane, S.D., D.R. Cherek, O.V. Tcheremissine, L.M. Lieving, and

Williams and Wilkins, Vol. 1, (2000) pp. 677–688.

C.J. Pietras, "Acute Marijuana Effects on Human Risk Taking."

Saxena, S., and K.M. Maidment, "Treatment of Compulsive Hoard-

Neuropsychopharmacology, April, 30, 4, (2005a) pp. 800–809.

ing." Journal of Clinical Psychology, November, 60, 11, (2004)

Lane, S.D., O.V. Tcheremissine, L.M. Lieving, S. Nouvion, and

pp. 1143–1154.

D.R. Cherek, "Acute Effects of Alprazolam on Risky Decision

Schwager, J., Stock Market Wizards: Interviews with America's Top

Making in Humans." Psychopharmacology (Berlin), April 14

Traders. New York: Harper Business (2003).

Schwartz, N., "Mood, Misattribution, and Judgments of Well-Being:

Lo, A., and D. Repin, "The Psychophysiology of Real-Time Finan-

Informative and Directive Functions of Affect States." Jour-

cial Risk Processing." Journal of Cognitive Neuroscience, 14,

nal of Personality and Social Psychology, 45, (1983) pp. 512–

(2002) pp. 323–339.

Lo, A., D. Repin, and B. Steenbarger, "Fear and Greed in Financial

Shiv, B., G. Loewenstein, A. Bechara, H. Damasio, and A.R. Dama- 930

Markets: A Clinical Study of Day-Traders." NBER working

sio, "Investment Behavior and the Negative Side of Emotion."

paper (2005).

Psychological Science, June, 16, 6, (2005) pp. 435–439.

Loewenstein, G.F., E.U. Weber, C.K. Hsee, and N. Welch, "Risk as

Simmons, A., S.C. Matthews, M.B. Stein, and M.P. Paulus, "An-

Feelings." Psychological Bulletin, 2, (2001) pp. 267–286.

ticipation of Emotionally Aversive Visual Stimuli Activates

Lucas, R.E., and B.M. Baird, "Extraversion and Emotional Reactiv-

Right Insula." Neuroreport, October 5, 15, 14, (2004) pp. 2261– 935

ity." Journal of Personality and Social Psychology, March, 86,

3, (2004) pp. 473–485.

Slovic, P., M. Finucane, E. Peters, and D.G. MacGregor, "The Af-

Lucey, B.M., and M. Dowling, "The Role of Feelings in Investor

fect Heuristic." In T. Gilovich, D.W. Griffin, and D. Kahneman,

Decision-Making." Journal of Economic Surveys, April, Vol.

eds., Heuristics and Biases: The Psychology of Intuitive Judg-

19, No. 2 (2005).

ment. New York: Cambridge University Press, (2002) pp. 397– 940

Mellers, B.A., A. Schwartz, and I. Ritov, "Emotion-Based Choice."

Journal of Experimental Psychology, 128, (1999) pp. 332–345.

Soros, G., Soros on Soros. New York: John Wiley & Sons (1995).

Mobbs, D., C.C. Hagan, E. Azim, V. Menon, and A.L. Reiss, . "Per-

Spencer, H., Principles of Psychology. New York: Appleton Press

sonality Predicts Activity in Reward and Emotional Regions

Associated with Humor." Proceedings of the National Academy

Steenbarger, B., The Psychology of Trading. New York: John Wiley 945

of Sciences, USA. November 8, 102, 45 (2005).

& Sons (2003).

Nesse, R., "Is the Market on Prozac?" The Third Culture, online

Trepel, C., C.R. Fox, and R.A. Poldrack, "Prospect Theory on the

journal, February 28 (2000).

Brain? Toward a Cognitive Neuroscience of Decision under

Oberlechner, T., "Perceptions of Successful Traders by Foreign Ex-

Risk." Brain Research: Cognitive Brain Research, April, 23, 1,

change Professionals." Journal of Behavioral Finance, Vol. 5,

(2005) pp. 34–50.

No. 1, (2004) pp. 23–31.

Willis-Owen, S.A., M.G. Turri, M.R. Munafo, P.G. Surtees, N.W.

Odean, T., and B. Barber, "Are Investors Reluctant to Realize Their

Wainwright, R.D. Brixey, and J. Flint, "The Serotonin Trans-

Losses?"" Journal of Finance, October, Vol. LIII, No. 5, (1998)

porter Length Polymorphism, Neuroticism, and Depression: A

pp. 1775–1798.

Comprehensive Assessment of Association." Biological Psy-

Paulus, M.P., J.S. Feinstein, G. Castillo, A.N. Simmons, and M.B.

chiatry, July 13 (2005).

Stein, "Dose-Dependent Decrease of Activation in Bilateral

Wright, P., G. He, N.A. Shapira, W.K. Goodman, and Y. Liu, "Dis-

Amygdala and Insula by Lorazepam During Emotion Process-

gust and the Insula: fMRI Responses to Pictures of Mutilation

ing." Archives of General Psychiatry, March, 62, 3, (2005) pp.

and Contamination." Neuroreport, October 5, 15, 15, (2004)

pp. 2347–2351.

Source: http://www.richard.peterson.net/Peterson07_NeuroscienceOfInvestingProofs.pdf

This article is protected by copyright. To share or copy this article, se ISSN#10786791. To subscribe, THe FAILURe OF RISk FACTOR TReATmeNT FOR PRImARy PReVeNTION OF CHRONIC DISeASe mark A. Hyman, mD Mark A. Hyman, MD, is a contributing editor of Alternative physical activity, and exposure to environmental toxins affecting Therapies in Health and Medicine. He launched the Functional

Keith Hawton, Kees van Heeringen Lancet 2009; 373: 1372–81 Suicide receives increasing attention worldwide, with many countries developing national strategies for prevention. Centre for Suicide Research, Rates of suicide vary greatly between countries, with the greatest burdens in developing countries. Many more