Cialis ist bekannt für seine lange Wirkdauer von bis zu 36 Stunden. Dadurch unterscheidet es sich deutlich von Viagra. Viele Schweizer vergleichen daher Preise und schauen nach Angeboten unter dem Begriff cialis generika schweiz, da Generika erschwinglicher sind.

Introduction to financial markets and instruments

Introduction to Financial Markets and Instruments

Department of Mathematical Sciences

University of Stellenbosch

P. Ouwehand (Stellenbosch Univ.)

What is Finance About?

Finance may be defined as the study of how people allocate scarceresources over time.

Two of the distinguishing features of financial decision–making arethat the outcomes of financial decisions (costs and benefits) are

I spread over time

I not generally known with certainty ahead of time, i.e. subject to an

In essence, finance rests on three pillars:

(1) Time value of money(2) Valuation (of assets, e.g. stocks, bonds, derivatives etc.)(3) Risk management

P. Ouwehand (Stellenbosch Univ.)

Interest and Return

Financial decisions involve costs/benefits that are spread over time.

Decision makers must therefore be able to compare the values ofcashflows at different dates.

The time value of money refers to the fact that a $1.00 in the handtoday is worth more than the expectation of receiving $1.00 at somefuture date.

There are at least 3 reasons for this:

(1) Opportunity Cost: You can invest the money now, and end up with a

larger sum in the future. If you are unwilling to do that, you can lendthe money to someone who is prepared to take that risk, at a premium.

(2) Uncertainty: There is an element of uncertainty as to whether you

will, in fact, receive this sum in the future: Credit risk

(3) Inflation: The purchasing power of money changes (generally

decreases) over time.

P. Ouwehand (Stellenbosch Univ.)

Interest and Return

A person who lends money is giving up the opportunity to convertthose funds into goods or services.

He/she is also taking on some default risk, namely the chance thatthe borrower is unable/unwilling to return the amount.

Thus borrowing isn't free: the borrower should pay a premium toinduce the lender to part with his/her money. This premium is theinterest.

The magnitude of the interest depends on a number of factors:

I Economic factors: Money supply, inflation, trade deficit figures

I Credit risk: Government debt (Treasuries/Gilts) generally pays the

lowest rate interest: They are often regarded as risk–free.

Non-investment–grade or "junk" bonds have the highest yields. Thespread between these rates reflects perceived default probabilities.

Fundamental relationship in finance:

E[Return] = f (Risk)

where f is an increasing function.

P. Ouwehand (Stellenbosch Univ.)

Types of Interest Rate

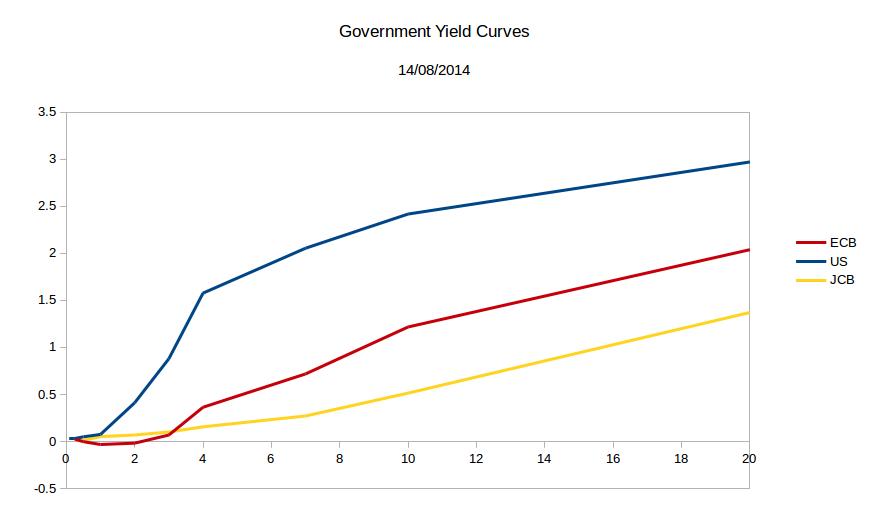

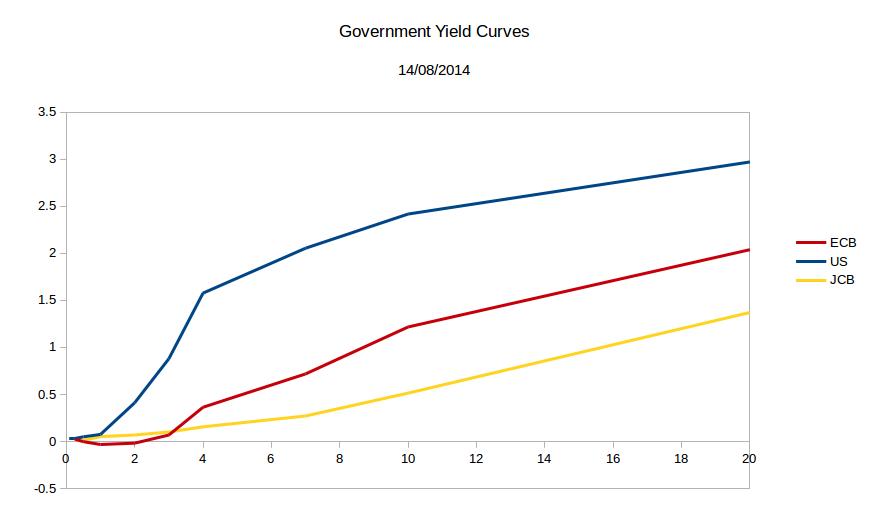

Interest rates vary over time. At any time, they also vary overdifferent maturities.

The magnitude of interest rates depends on:

I Economic factors (inflation, trade deficit figures, etc.);

I Credit rating of the borrower.

Simplifying assumption: INTEREST RATES ARE CONSTANT

Simple Interest: Invest P0 at a rate of r for T years. Receive

Discretely compounded interest: Invest P0 at a rate of r for Tyears, compounded n times annually. Receive

P. Ouwehand (Stellenbosch Univ.)

Types of Interest Rate

Continuously compounded interest: Invest P0 at a rate of r for Tyears, compounded continuously. Receive

PT is the future value of P0, and P0 the present value of PT .

Given the expectation of receiving an amount F at a future date T ,its value today is obtained by discounting: PV(F ) = Fe−rT

PV and FV allow one to compare different cashflows at differenttimes.

P. Ouwehand (Stellenbosch Univ.)

P. Ouwehand (Stellenbosch Univ.)

Returns are similar to interest rates. The main difference is that aninterest rate is a promised return on a deposit, whereas the returns onother assets are generally uncertain (i.e. risky)

You bought one share of Xcor one year ago for R123.45. Today theshare pays a dividend of R12.00 and the share price is now R135.40.

The net income provided by the share is

135.40 + 12.00 − 123.45 = 23.95

The investment cost R123.45, so the rate of return is

P. Ouwehand (Stellenbosch Univ.)

You deposited R123.45 in a bank one year ago. Today, you withdrawR12.00, and R135.40 remains in your bank account. What was thesimple rate of interest?

Before withdrawal, total was R147.40.

Thus 123.45(1 + r ) = 147.40.

Shares are riskier investments than deposits. Thus the expectedreturn on a share should be greater than the interest offered by abank account.

Note that returns can be negative, whereas interest rates must bepositive.

P. Ouwehand (Stellenbosch Univ.)

The return on an investment is roughly the percentage by which itsvalue has increased in one year, i.e.

Final Price + Interim Cashflows – Initial Price

Shares with a higher expected return are therefore riskier than shareswith a low expected return.

I If two shares had the same risk, but different expected returns,

everyone would buy the share with the higher return (and short theshare with the lower return).

I This would drive the price of the "high return" share up, thus lowering

The riskiness of a share is measured by a quantity called volatility: Itis the standard deviation of annualized returns.

Returns may also be measured as discretely– or continuouslycompounded.

Returns on bonds are called yields.

P. Ouwehand (Stellenbosch Univ.)

The volatility σ of an asset is the standard deviation of the annualisedreturns. Now the standard deviation of returns over a period of length

T is just σ T .

The reason for this is that variances of independent increments addup: σ∆S is the standard deviation of the annual change in S. Nowthe change in S over a period T is given by

Var(St − St−1)

assuming that the random variables St − St−1 are mutuallyindependent.

If we assume that the random variables St − St−1 are identicallydistributed, then they will all have the same variance σ2 .

P. Ouwehand (Stellenbosch Univ.)

Thus if σd is the daily volatility (=standard deviation of daily returns)of the asset, then

Actually, traders use a "shorter year". Thus if there are 252 tradingdays in the year, they would calculate annual volatility as

σ = σd 252.

P. Ouwehand (Stellenbosch Univ.)

P. Ouwehand (Stellenbosch Univ.)

P. Ouwehand (Stellenbosch Univ.)

Markets and Instruments

Traders in a financial market exchange securities for money.

Securities are contracts for future delivery of goods or money, e.g.

One distinguishes between underlying (primary) and derivative(secondary) instruments.

Examples of underlying instruments are shares, bonds, currencies,interest rates, and indexes.

A derivative is a financial instruments whose value is derived from anunderlying asset.

Examples of derivatives are forward contracts, futures, options,swaps,. .

P. Ouwehand (Stellenbosch Univ.)

Markets and Instruments

One also distinguishes between primary and secondary markets.

Securities are issued for the first time on the primary market, andthen traded on the secondary market. The secondary market providesimportant liquidity.

Borrowing and lending is done in fixed–income markets. The moneymarket is for very short–term debt (maturities ≤ 1 yr.)

Finally, we distinguish between the spot market and the forwardmarket.

I Most transactions are spot transactions: Pay now, and receive goods

I To hedge/speculate on future market movements, it is possible to sell

goods for delivery in the future. Forward and futures contracts arederivatives which make this possible.

P. Ouwehand (Stellenbosch Univ.)

Markets and Instruments

Equity: Stocks, shares. Ownership of a small piece of a company.

I Shareholders own a corporation. Directors act in the shareholders'

best interest.

I Public limited companies are listed on a stock exchange. Ownership is

easily transferred. The shareholders share the profits of the company,but have limited liability: At most, they can lose their investment.

Most shares pay regular dividends, whose amount varies according toprofitability and opportunities for growth.

P. Ouwehand (Stellenbosch Univ.)

Markets and Instruments

Short selling: Selling a share you don't own, hoping to pick them upmore cheaply later on.

I Your broker borrows the share from a client.

I You may now sell these shares, even though you don't own them.

I Later, you buy the shares in the market and return them to your

broker, who returns them to the other client. You also pay anydividends that were issued in the interim.

Commodities: Raw materials such as metals, oil, agriculturalproducts, etc. These are often traded by people who have no need forthe material, but are speculating on the direction of the commodity.

Most of this trading is done in the futures market, and contracts areclosed out before the delivery date.

Currencies: FOREX.

P. Ouwehand (Stellenbosch Univ.)

Markets and Instruments

Indices: An index tracks the changes in a hypothetical portfolio ofinstruments (S&P500, DIJA, FTSE100, DAX–30, NIKKEI225,NASDAQ100, ALSI40, INDI25, EMBI+, GSCI). A typical indexconsists of a weighted sum of a basket of representative stocks. Theserepresentatives and their weights may change from time to time.

Fixed income securities:

I Bonds, notes, bills. These are debt instruments, and promise to pay a

certain rate of interest, which may be fixed or floating.

I Example: A 10–year, 5% semi–annual coupon bond with a face

value of $1m promises to pay $25 000 every six months for 10 years,and a balloon of $1m at maturity.

I Annuities pay out a fixed amount at regular intervals in return for an

upfront lump sum. Mortgages are an example.

P. Ouwehand (Stellenbosch Univ.)

Financial Derivatives

A derivative security is a a financial contract whose value is derivedfrom an underlying variable, such as a stock price, the level of anindex, or an interest rate.

I A stock option's value depends on the value of the underlying stock.

I The price of a zero coupon bond depends on the prevailing interest

I The profit/loss made by buying oil futures depends on the changes in

the spot price of oil.

The two main reasons for using derivatives are

I Speculation.

Derivatives are tools for transferring risk

Arbitrageurs are a third type of market agent: These seek low riskprofits by entering off-setting positions in different markets orinstruments.

P. Ouwehand (Stellenbosch Univ.)

Financial Derivatives

A forward contract is an agreement to buy or sell an asset S (theunderlying) at a certain date T (delivery date, maturity) for a certainprice F (forward price, delivery price).

I The party who agrees to buy the asset is said to have the long position,

and the party that agrees to deliver the asset is said to have the shortposition.

I Provided that the forward price F is chosen carefully, this contract

initially has no value, i.e. it costs neither party anything to enter intothe contract. As time goes by, the value of the contract changes.

I Suppose that the spot price of the asset at time T is denoted by S (T ).

The party with the long position therefore agrees to pay F for what isworth S (T ). The payoff to the holder of the long position is thereforeS (T ) − F . (This may be positive or negative.) The payoff to the partywith the short position is F − S (T ).

A futures contract is very similar to a forward contract. However,there are mechanisms in place which assure that profits and losses arepaid throughout the life of the futures contract, rather than just atmaturity.

P. Ouwehand (Stellenbosch Univ.)

Payoff for long and short positions in a forward contract.

P. Ouwehand (Stellenbosch Univ.)

Using Forwards to Hedge

BakeCor, a large bakery, knows that it will need 1 000 bushels ofwheat in 6 months' time.

The current price of wheat is R10.00 per bushel. Ignoring interestrates, the managers at BakeCor enter into a forward contract with afarmer to buy 1 000 bushels in 6 months' time at R10.00 per bushel.

BakeCor does this because the price of wheat 6 months' hence isuncertain, depending on a large number of factors, including theweather.

By entering into a forward contract, BakeCor locks into apredetermined price and eliminates this risk.

However, this elimination comes at some cost: If the weather is good,wheat prices will be lower than they are now, but BakeCor can nolonger profit from this price drop: Its payoff is negative.

In this example, both BakeCor and the farmer are using a derivativeto hedge.

P. Ouwehand (Stellenbosch Univ.)

Using Forwards to Speculate

Investor X has some reason for expecting a bumper crop of wheat thisyear.

She therefore expects the price of wheat to drop drastically, and takesa short position in a forward contract.

She agrees to deliver 1 000 bushels of wheat at R10.00 per bushel in6 months' time.

Investor X does not currently own any wheat; she is speculating. Sheexpects to be able to buy the wheat for R7.00 per bushel in 6months' time and will deliver this to the holder of the long position,thus making a profit of R3.00 per bushel.

If she is wrong about wheat prices however, and it rises to R15.00 perbushel, she will make a loss of R5.00 per bushel.

P. Ouwehand (Stellenbosch Univ.)

An option gives the holder the right, but not the obligation to buy or sellan asset.

A European call option gives the holder the right to buy an asset S (theunderlying) for an agreed amount K (the strike price or exercise price) ona specified future date T (maturity or expiry).

The party who undertakes to deliver the asset is called the writer ofthe option.

The buyer of a European call would exercise at time T only ifK < S (T ), for a profit of S (T ) − K .

If the spot price is less than the strike, the holder would discard theoption: Why pay K if you can pay S (T ) < K ?

Thus the payoff to the holder is max{S (T ) − K , 0} ≥ 0.

Unlike forward contracts, options cost money. You have to pay thewriter of an option a premium upfront to enter into the contract.

P. Ouwehand (Stellenbosch Univ.)

A European put option confers the right to sell an asset S for anagreed amount K at a specified future date T .

Similarly, an American call (put) option confers the right to buy (sell)an asset S for an agreed amount K , but at any time at or beforematurity T .

An Asian option has a payoff that depends on the average stock priceover a certain time period.

A knock–out barrier call will pay the same as a European call, butonly if the underlying asset price hasn't crossed a predeterminedbarrier level.

The list of examples of derivatives is endless: Interest rate swaps,interest rate caps and floors, forward rate agreements, credit defaultswaps. .

P. Ouwehand (Stellenbosch Univ.)

Payoff and pwith strike K .

P. Ouwehand (Stellenbosch Univ.)

Hedging with Options

An investor owns 1 000 shares of Anglo, with value R60.00 per share.

If the share price drops to R45.00, this will lead to a loss of R15 000.

To hedge against possible loss, the investor buys a put option to sell1 000 shares in 3 months time at a price of R55.00 per share. Theoption costs R2 000.00.

This limits the losses to R5 000 + R2 000 = R7 000.00

If the stock price rises to R70.00, the investor will not exercise theoption.

In that case the investor's profit will be R10 000 - R2 000 = R8 000.

The investor thus has put a cap on possible losses without restrainingthe possible gains.

P. Ouwehand (Stellenbosch Univ.)

Speculating with Options

Investor X believes that the shares of pharmaceuticals will rise sharply.

She is willing to speculate with a capital of R10 000.

Today, the shares of PharmCor trade at R50.00.

I If Investor X buys 200 shares and the share price rises to R60.00, she

will make a profit of $2 000.

I If the price drops to R40.00, her loss will be $2 000.

A call option to buy 100 PharmCor shares at strike R53.00 costsR200.

I If Investor X buys 50 call options and the share price rises to 60.00, she

will exercise the options and buy 5 000 shares at R53.00 per share.

I She will immediately sell these at R60.00 per share.

I Her profit is therefore

5 000 × (60 − 53) − 50 × 200 = 25 000

i.e. a profit of R25 000, instead of just R2 000.

I BUT: Should the share price remain below R53.00, she will lose

P. Ouwehand (Stellenbosch Univ.)

Speculating With Options

This example shows how options can be used as speculative tools thatprovide leverage: Good outcomes become very good, whereas badoutcomes become very bad.

The term leverage (or gearing) refers to any method to multiplygains and losses. This is often achieved by borrowing.

A highly leveraged firm is one whose assets =

assets - liabilities

Suppose that you take out a mortgage loan from a bank in order tobuy a house. The house costs R10 million, and you borrow 8 million,putting down 2 million deposit.

I If the house price increases by 20% to 12 million, you have made a gain

of 2 million, using an initial capital of 2 million: You have made a100% return!

I But if the house price decreases by 10% to 9 million, you have lost half

your initial capital, i.e. a return of −50%.

I The leverage here is

10 000 000−8 000 000

Gains and losses are multiplied by a factor of 5.

P. Ouwehand (Stellenbosch Univ.)

Global Derivatives Markets

Table 19: Amounts outstanding of over-the-counter (OTC) derivatives

By risk category and instrument

In billions of US dollars

Notional amounts outstanding

Gross market values

Risk Category / Instrument

Jun 2012 Dec 2012

Jun 2013 Dec 2013

Jun 2012 Dec 2012

Jun 2013 Dec 2013

641,309 635,685 696,408 710,633 691,492 25,519 24,953 20,245 18,825 17,423

exchange

66,672 67,358 73,121 70,553 74,782 2,249 2,313 2,427 2,284 1,722

31,395 31,718 34,421 33,218 35,190 773 806 957 824 571

24,156 25,420 24,654 25,448 26,141 1,190 1,259 1,131 1,186 939

11,122 10,220 14,046 11,886 13,451 286 249 339 273 213

Interest

496,215 492,605 564,673 584,799 563,290 19,216 19,038 15,238 14,200 13,461

65,181 71,960 86,892 78,810 92,575

380,720 372,293 428,385 456,725 421,273 17,317 17,285 13,745 12,919 12,042

50,314 48,351 49,396 49,264 49,442 1,848 1,706 1,325 1,174 1,292

6,313 6,251 6,821 6,560 6,941 639 600 692 700 666

2,433 147 157 206 202 191

4,508 492 443 486 498 475

Commodity

2,993 2,587 2,458 2,204 2,206 379 347 384 264 269

523 486 461 341 319 51 42 80 47 32

1,887 328 304 304 217 237

1,659 1,363 1,327 1,260 1,283

812 739 670 603 604

26,930 25,068 24,349 21,020 19,462 1,187

15,566 14,309 13,135 11,324 10,845 715 527 430 369 368

8,617 472 321 295 284 266

of which index products

42,185 41,815 24,986 25,496 24,810 1,849 1,808

Memorandum Item:

Gross Credit Exposure

P. Ouwehand (Stellenbosch Univ.)

Table 20A: Amounts outstanding of OTC foreign exchange derivatives

By instrument and counterparty

In billions of US dollars

Notional amounts outstanding

Gross market values

Instrument / counterparty

Jun 2012 Dec 2012

Jun 2013 Dec 2013

Jun 2012 Dec 2012

Jun 2013 Dec 2013

66,672 67,358 73,121 70,553 74,782 2,249 2,313 2,427 2,284 1,722

29,484 28,834 30,690 31,206 31,971 881 946 992 1,011 709

27,538 28,831 31,757 30,552 33,700 885 911 999 887 693

9,111 483 456 437 386 321

Outright forwards and foreign

exchange

31,395 31,718 34,421 33,218 35,190

11,576 11,083 11,846 11,647 11,931 282 295 360 325 209

14,023 14,860 16,441 16,506 18,245 337 351 421 359 263

5,796 5,775 6,134 5,066 5,014 153 160 175 140 99

Currency

24,156 25,420 24,654 25,448 26,141 1,190 1,259 1,131 1,186

12,698 12,895 12,443 13,720 13,889 463 529 464 543 394

9,463 472 488 462 432 352

2,789 255 241 205 211 193

11,122 10,220 14,046 11,886 13,451

6,151 135 123 167 143 106

4,429 4,162 5,635 5,022 5,992 76 71 116 96 77

1,308 75 55 56 35 29

BIS Quarterly Review, December 2014

Figure : Source: BIS Quarterly review, December 2012

Global Derivatives Markets

To illustrate the growth of derivatives markets: The December 1999BIS Quarterly Review reported the total amounts outstanding asroughly $100 trillion. Three years later, it rose to around $150 trillion,and currently it stands at about $700 trillion.

Note that notional amounts are not the same as the values of thecontracts. They are an estimate of an equivalent position in the spotmarket, i.e. one that has the same response to market factors.

I For example, a forward contract on a share is approximately equivalent

to the share, but the forward costs nothing to enter into, i.e. initiallyhas zero market value.

I Similarly, the premium for a call option is much smaller than the value

of the (delta–)equivalent position in the underlying share.

The notional amount for OTC contracts is given as $691.5 trillion,but the gross market value of these contracts amount to "only" $17.4trillion (up from $ 2.8 trillion in 1999, but now dropping due to newregulations.).

For comparison, the world GDP is about $70 trillion.

P. Ouwehand (Stellenbosch Univ.)

Fixed Income Securities

The term "fixed income security" originally referred to instrumentsthat pay a fixed rate of interest, usually fixed coupon bonds.

Example: The R204 is a SA government bond with a face value(orpar value, or principal amount) of R1 million and a 8% coupon thatmatures on the 21st of December 2018. Since coupon payments aremade semiannually in South Africa, the bond holder will receive 4% ofR1 million, twice a year (i.e. R40 000 on the 21th of June and the 21stof December) until 2018. On 21 December 2018, the bond holder willreceive R 1 040 000 — i.e. the principal plus the final coupon.

Example: The R157 bond pays a 13.5% semiannual coupon. Itmatures on the 15th of September 2014/2015/2016. On each ofthese three dates it will pay 1 of the principal amount. It will

continue to pay a 13.5% coupon on the remainder of the principaluntil 15/09/2016.

P. Ouwehand (Stellenbosch Univ.)

Fixed Income Securities

A bond is said to trade at par if its price is equal to its face value. Ifits price is above (below) its face value, the bond is said to trade at apremium (discount).

Even though the cashflows of the bond are known exactly in advance,bond prices can oscillate wildly.

These days the definition of "fixed income securities" includes manydebt instruments whose promised cashflows are far from fixed.

P. Ouwehand (Stellenbosch Univ.)

There are many types of quoted interest rate: mortgage rates, depositrates, prime overdraft rates, etc. These rates fluctuate with the state ofthe economy, with perceived risk, tax legislation, etc. For our purposes themost important are

Treasury Rates: Rates at which a government can borrow in its owncurrency. Since governments are amongst the most prolific borrowers,the market in government debt is often quite large and quite liquid.

Such government debt is, moreover, regarded as riskless.

LIBOR Rates: LIBOR stands for London Interbank Offer Rate.

These are rates at which large banks (AA-rated) are able to borrowfor the short–term (1–12 months). LIBOR rates are higher thanTreasury rates.

I If 3–month LIBOR is 5.675%, then a large bank is willing to lend at an

annualized rate of 5.675% over a 3–month period.

I Similarly, LIBID stands for London Interbank Bid Rate, the rate at

which a bank is prepared to accept deposits (borrow).

P. Ouwehand (Stellenbosch Univ.)

I LIBOR rates are higher than Treasury rates because they are not

risk–free. Nevertheless, traders prefer to use LIBOR rates as a proxy for"actual" risk–free rates, because regulatory policies increase thedemand for Treasury instruments, thereby decreasing the associatedTreasury rates (yields).

I Government monetary policy is primarily transmitted to the economy

via the interbank market. Any manipulation of central bank rates isquickly transmitted to the interbank market, and from there to theeconomy.

Repo Rate: A repo or repurchasing agreement is a contract wherebya one party agrees to sell securities it owns now, and to buy themback a short while later at a slightly higher price.

This is like a loan with the securities as collateral. The differencebetween the sell price and the buy–back price implies an interest rate,the repo rate.

In South Africa, the repo rate refers to repurchase transactionsbetween the reserve bank and its clients, the local banks.

P. Ouwehand (Stellenbosch Univ.)

Types of Fixed Income Securities

A money market account is simply a bank account which offers theprevailing (and thus constantly changing) rate of interest.

Fixed coupon bonds have already been defined.

Zero coupon bonds do not pay any coupons, but only the principalat maturity. These are a form of short term debt. Some examples areTreasury bills, commercial paper, banker's acceptances . NegotiableCertificates of Deposit (NCD's) are another example.

Floating rate notes (FRN's) are bonds that pay a variable coupon atregular intervals. This variable coupon is generally linked to somemarket–observable reference rate.

P. Ouwehand (Stellenbosch Univ.)

Types of Fixed Income Securities

Example: A 18–month $1 million FRN paying LIBOR +2%semiannually in arrears, will at 6–month intervals pay

1 × 1 000 000 × [LIBOR + 2%]

where LIBOR is the variable 6–month LIBOR rate observed in themarket 6 months before the coupon payment.

If 6–month LIBOR evolves as in the 2nd row of the table below. Thencashflows associated with the FRN are shown in the 3rd row:

The dates t = 0, 6, . . etc. are called the reset dates.

P. Ouwehand (Stellenbosch Univ.)

Bond Pricing Basics

Let B(t, T ) be the time–t value of a zero coupon bond with principal 1and maturity T . With this price, we can associate several rates:

Discretely compounded rate id,n: This is defined by

where T is in years.

Continuously compounded rate ic : This is defined by

B(t, T ) = e−ic (T −t)

where T is in years.

Note that as the compounding frequency increases the associated ratedrops, i.e.

is ≥ id,2 ≥ id,3 ≥ · · · ≥ ic

Intuitively, money is working harder as the compounding frequencyincreases, so you need a smaller rate to get the same result.

P. Ouwehand (Stellenbosch Univ.)

Bond Pricing Basics

For pricing purposes, the notion of a zero rate or spot rate isinvaluable.

I The n–year zero rate is defined to be the rate implied by the price of a

(possibly synthetic) zero coupon bond that matures in n years.

Most zero coupon bonds have very short maturities, so mostmarket–observable rates are not zero rates.

Nevertheless, the spot rate curve can be (imperfectly) extracted frommarket data by a technique known as bootstrapping the yield curve.

P. Ouwehand (Stellenbosch Univ.)

Bond Pricing Basics

Example: Suppose that we are given the following term structure of zerocoupon bonds, i.e. the prices of zero coupon bonds with face value 1 andmaturities T :

It is easy to see that the continuously and semiannually compounded ratesimplied by these prices are

P. Ouwehand (Stellenbosch Univ.)

Bond Pricing Basics

Suppose that we want to price a 2–year bond with an 8% semiannualcoupon and face value $1 million. This bond will pay $40 000 at eachof t = 0.5, 1.0, 1.5 and $1 040 000 at t = 2.0.

It can therefore be seen as a portfolio of 40 000 of each ofB(0, 0.5), B(0, 1.0), B(0, 1.5) and 1 040 000 of B(0, 2.0). Its price istherefore

P = 40 000[0.96 + 0.91 + 0.85] + 1 040 000[0.78]

On the other hand, we can also calculate the price as

P. Ouwehand (Stellenbosch Univ.)

Price is not the best way to compare bonds:

I Suppose that bond A is a 2–year bond paying a semiannual coupon of

8% which costs $920 000.

I Suppose further that bond B is a 3–year bond paying a semi–annual

coupon of 10% which costs $930 000.

I Which bond is best?

I The price alone tells you nothing. What you need to know is the rate

of return on the capital you invest.

I The bond with the highest rate of return is the better one (other things

being assumed equal).

I The internal rate of return of a bond is called its yield.

The yield (or yield–to–maturity, YTM) of a bond y is defined to bethat number y which gives the correct price of the bond if itscashflows are discounted at a rate of y .

P. Ouwehand (Stellenbosch Univ.)

Example: To find the semiannually compounded yield of bond Aabove, we have to solve the following equation for y :

I In this case, we have to find the roots of a fourth degree polynomial.

I For bond B we would have to find the roots of a 6th degree polynomial.

I In general, we cannot find the yield of an arbitrary bond exactly, but

will have to use a numerical method, such as the bisection method orNewton's method.

I Solving, we find that Bond A has a yield of 12.65%, whereas bond B

has a yield of 12.89%.

I Thus Bond B offers the higher rate of return, and is therefore a better

deal (other things being equal).

In the USA bonds are quoted in price, whereas in SA they are quotedin yield.

Note that if the yield of a bond increases, then its price decreases,and vice versa, i.e. price and yield are

P. Ouwehand (Stellenbosch Univ.)

If the coupon rate equals the yield, then the bond trades at par.

(assuming that we are pricing at t = 0 or on a coupon date.)

I The yield y on a bond is essentially the rate of return demanded by the

market, whereas the coupon c is the rate of return offered by the bond(as a percentage of the par value).

I If c = y , then the rate demanded is equal to the rate offered, and the

price of the bond does not need to change.

I If the rate demanded by the market is higher than the rate offered, then

the bond is not attractive at its current price, and its price will drop, sothat the coupon will form a greater percentage of the bond's new value.

I The opposite is true if y < c , and the bond will trade at a premium.

Mathematically, if c is paid n times annually, and if the n–timesannually compounded yield is y , then the bond price is

Clearly P ≥ F if and only if c ≥ y .

P. Ouwehand (Stellenbosch Univ.)

par yield: (or par bond yield) This is the coupon rate that causes thebond to equal its face value. To find the par yield of a bond withmaturity T and a semiannually compounded coupon, you have tosolve the following equation for c:

P. Ouwehand (Stellenbosch Univ.)

Floating Rate Notes

Suppose that ABCor has issued a face = $1 million FRN today,paying LIBOR quarterly.

I Today 3 month LIBOR is 13%. Investors therefore require a return of

13% in order to invest in ABCor debt, i.e. they require an amount of$32 500 on $1 million over 3 months.

I After 3 months, the FRN pays a coupon of $32 500, i.e. the investors

are paid the interest that they require.

I The value of the FRN after 3 months is therefore again $1 million.

I Market conditions have now changed, and LIBOR is 11%. The coupon

is now reset to 12%, because investors now require a return of 12% onABCor debt.

I After 3 months, the FRN pays the required interest, so after 6 months,

the value of the FRN is again equal to $1 million.

Thus an FRN is very must like a deposit in a bank account at floatingrates, where the interest is withdrawn from the bank account atregular intervals. Of course, if all interest paid is withdrawn, the valueof the deposit equals its initial value. Hence:

On a reset date, a floating rate note trades at par.

P. Ouwehand (Stellenbosch Univ.)

Pricing Derivative Securities

Because the value of a derivative is derived from another asset ormarket variable, it is sometimes possible to find a mathematicalformula for the price.

Tomorrow, Allegra and Darcy will face each other in the finals atWimbledon.

Tickets are available to gamble on the outcome of the game:

I If Allegra wins, the holder of a ticket gets R10 000.

I If Darcy wins, the holder gets nothing.

Because the payoff is non–negative, such a ticket cannot be free.

What would you be willing to pay for such a ticket?

Mathematics cannot be used to determine the price of this ticket. Itis determined by punters combined views on who is likely to win, aswell as their risk preferences.

P. Ouwehand (Stellenbosch Univ.)

Pricing Derivative Securities

Example: (Continued)

Suppose the market price of the ticket is P.

Suppose also that there is a second type of ticket available: Thisticket pays R10 000 if Darcy wins, and R0 if Allegra wins.

We can determine the price of the second ticket mathematically:

If you own one of each kind, you will definitely get R10 000. So theprice of both tickets must be R10 000, and hence the price of thesecond ticket is 10 000 − P.

The second ticket is a derivative of the first ticket — once the marketdecides the price of the first ticket, the price of the second ticket isdetermined, independent of views and risk preferences of punters.

P. Ouwehand (Stellenbosch Univ.)

In order to be able to use mathematics to find prices, we assume onlythat you can't make money from nothing:

Law of One Price:Two securities that are guaranteed to have thesame value at time t = T must have the samevalue at time t = 0.

For suppose that X , Y are securities, and that XT = YT in all statesof the world.

I If X0 < Y0, you can buy X and sell Y at time t = 0 — for an

immediate profit of Y0 − X0.

I At time T , you have XT and you owe YT — and these cancel!I So if X0 < Y0, you can make money from nothing!!!!!I If X0 > Y0 do the opposite.

P. Ouwehand (Stellenbosch Univ.)

Interest Rate Swaps

The most common type of interest rate swap is the fixed–for–floatingswap (also called a plain vanilla swap).

These are OTC instruments in which one party agrees to makepayments on a notional amount at a fixed rate in return for floatingrate payments. The reference floating rate is most often a LIBORrate.

Suppose that corporation A has borrowed from a bank at floatingrates, but would prefer to pay a fixed rate. Corporation B, on theother hand has issued a fixed coupon bond, but is of the opinion thatshareholder value will be maximized if it transforms its debt tofloating rate debt.

On 7 February 2013, the two counterparties enter a three–year swap.

A agrees to pay B a fixed rate of 10% on a notional of $100 million,making semiannual payments. In return, B agrees to pay B 6–monthLIBOR.

P. Ouwehand (Stellenbosch Univ.)

Interest Rate Swaps

If 6–month LIBOR was 9% on 07/02/2002, then A will pay B anamount of $5 million on 07/08/2002 (being half of 10% of $100million), and will receive $4.5 million in return.

If LIBOR moves according to the 2nd column in the table below, thenthe cash flows are given by the third and fourth columns:

Here A is the fixed rate payer, and B the floating rate payer. This isan in–arrears swap, because B pays A the floating rate at the end ofthe corresponding period.

Payments are netted, i.e. only the amount in the fifth column isexchanged.

P. Ouwehand (Stellenbosch Univ.)

Interest Rate Swaps

The rate paid by the fixed rate payer is called the swap rate, and ischosen so that the swap initially has zero value.

When the swap rate increases from its initial value, A has to pay lessinterest than the fair market rate. Hence the value of the swap is nowpositive to A (and negative to B).

In practice, corporation A and B do not generally get in touch witheach other. Instead A and B will each approach a financialintermediary, such as a bank, who will try to match counterparties,and keep a small spread.

Generally, A and B are not even aware of each other's existence, andA and B each have a contract with the intermediary, not with eachother. If A defaults on its payments, it is the intermediary thatsuffers, not B.

P. Ouwehand (Stellenbosch Univ.)

Interest Rate Swaps

P. Ouwehand (Stellenbosch Univ.)

Why Enter into a Swap?

Interest rate risk: A corporation servicing floating rate debt is at riskif interest rates go up, whereas a corporation with fixed rate debtfaces the risk of interest rates coming down. In order to hedge, it maybe desirable to have a mixture of fixed and floating rate debt.

Swaps transform fixed rate debt into floating rate debt, and vice versa.

Bank A has a portfolio of 5 year corporate loans with a face value of$100 million. Interest on all loans is 10%, paid semiannually.

To fund this loan, the bank depends on 6 month CD's, on which itpays 6 month LIBOR + 40 bp.

Thus A faces the risk that LIBOR ≥ 9.6%.

Life insurer B is committed to pay 9% on a guaranteed investmentcontract, on a notional of $100 million.

B has the opportunity to invest in an FRN paying LIBOR +160 bpsemiannually.

P. Ouwehand (Stellenbosch Univ.)

Why Enter into a Swap?

B will then face the risk that its obligations on the guaranteedinvestment fund are not offset by the coupons from the FRN, i.e. itfaces the risk that LIBOR ≤ 7.4%

Thus A and B face opposing risks: A is worried that LIBOR willincrease, and B is worried that LIBOR will decrease.

Moreover, if 7.4% ≤ LIBOR ≤ 9.6%, then both A and B are makingmoney. There is a spread of 9.6% - 7.4% = 2.2% which they oughtto be able to lock in on at no risk whatsoever1.

Financial intermediary C brokers a deal whereby it keeps 10 bp andpasses 1.05% to each client (so that 1.05% + 1.05% +10 bp =2.2%).

1Market risk, that is, not default risk.

P. Ouwehand (Stellenbosch Univ.)

Why Enter into a Swap?

P. Ouwehand (Stellenbosch Univ.)

Why Enter into a Swap?

A faces the risk that LIBOR will increase. To offset this risk, it shouldreceive LIBOR, and thus pay a fixed rate.

What should this fixed rate be? If A is going to receive a spread of1.05%, then the fixed rate x must be chosen so that10% + LIBOR − (LIBOR + 140 bp) − x % = 1.05%, so thatx = 8.55%.

C pockets 10 bp, and pays 8.45% to B.

B makes a total of LIBOR + 160bp + 8.45% − LIBOR − 9% = 1.05%.

Every one makes money!!

If A is paying LIBOR +40 bp and the FRN is paying LIBOR + 160bp, then the FRN probably carries a large amount of default risk.

P. Ouwehand (Stellenbosch Univ.)

Comparative Advantage

Some companies have a comparative advantage when borrowing infixed rate markets, whereas others have an advantage in floating ratemarkets. A firm that has an advantage borrowing at fixed rates, butwants a floating rate loan, may find it advantageous to enter into aswap.

Example: Consider two companies X and Y, who have been offeredthe following rates on a $10 million 5–year loan:

X wants a floating rate loan, and Y wants a fixed rate loan.

Note that X has been offered lower rates in both the fixed– and thefloating rate market; it has an absolute advantage, presumablybecause it is less credit risky.

However, the spread of X over Y in the fixed rate market is 80 bp,whereas in the floating rate market it is only 40 bp.

P. Ouwehand (Stellenbosch Univ.)

Comparative Advantage

Thus X is doing comparatively better in the fixed rate market,whereas Y is doing comparatively better in the floating rate market.

The difference in spreads is 80 - 40 = 40 bp. Assuming that this isshared equally between X and Y, with 10 bp going to a financialintermediary, X and Y should both be able to make 15 bp.

Consider the payments made by Y. Though Y wants a fixed rate loan,it takes out a floating rate loan and enters a swap. Similarly, X takesa fixed rate loan.

Y will now pay a fixed rate x % to the financial intermediary, payLIBOR+50 bp, and receive LIBOR, a total fixed rate of x + 50 bp. Ywould have had to pay 8.80% in the fixed rate market, but since itgains 15 bp, it only pays 8.65%, i.e. x + 50 bp = 8.65% . Thus Ypays 8.15% to the intermediary.

The intermediary pockets 10 bp, and pays 8.05% to A. A ends uppaying a net LIBOR - 5 bp, instead of LIBOR + 10 bp.

P. Ouwehand (Stellenbosch Univ.)

Comparative Advantage

P. Ouwehand (Stellenbosch Univ.)

A swap can be decomposed as follows:

I A receiver swap is equivalent to a long position in a fixed–coupon bond

and short position in a floating rate note.

Of course, a payer swap is just a short receiver swap, and thereforecorresponds to the opposite portfolios.

Example: Consider a 3–year receiver swap, where we receive a fixedcoupon of 5.5% in exchange for LIBOR on a notional of $100, withpayments made annually.

Assume that the term structure of zero coupon bonds is given by the2nd column of the table below. then the annually compounded spot–and forward rates are given by the third and fourth columns:

P. Ouwehand (Stellenbosch Univ.)

The cash flows of this swap are the same as for a portfolio consistingof long fixed coupon bond with a face value of $100, paying anannual coupon of 5.5%, and a short FRN with a face value of $100,paying annual LIBOR.

The value of the fixed coupon bond is

5.5 × 0.9615 + 5.5 × 0.9136 + 105.5 × 0.8591 = $100.95

The FRN trades at par, and so is worth $100. The value of the swapis therefore

Swap = Fixed coupon bond - FRN

P. Ouwehand (Stellenbosch Univ.)

The rate paid by the fixed rate payer is called the swap rate and ischosen so that the initial value of a swap contract is zero (par swap).

Since a swap is just a portfolio long a fixed coupon bond and short anFRN, the swap rate c must be chosen so that

Value of bond with coupon c = Value of FRN

But an FRN trades at par at t = 0, and so the swap rate c must bechosen so that

Value of bond with coupon c = Par

Thus the swap rate (for a given maturity) is none other than thecorresponding par yield.

Swap Rate = Par Yield

P. Ouwehand (Stellenbosch Univ.)

Forwards and Futures

Recall: A forward contract is an OTC (private) agreement betweena buyer and a seller to exchange a specified quantity of asset at aspecified price (the delivery price for delivery at a specified place andtime (maturity).

The delivery price and is set such that the initial value of the forwardcontract is zero, so that no cash is exchanged when entering thecontract. As time progresses, however, the contract will come to havea positive or negative value.

A futures contract is very much like a forward contract: It is anagreement to accept or deliver a specified asset at a specified time fora specified price. The mathematics of forward– and futures contractsis therefore very similar. For example, the initial value of a futurescontract is zero, just like for a forward contract.

P. Ouwehand (Stellenbosch Univ.)

Forwards and Futures

Nevertheless, there are important differences:

Forward Contracts

Futures Contracts

Tailored (Negotiated)

Standardized grades and quantities

Delivery date negotiated

A small range of delivery months

Settled at end of contract

Settled daily by marking–to–market

Usually settled by delivery

Usually closed out before delivery

Two parties with opposite interests

Between party and clearing house

Forwards vs. Futures

P. Ouwehand (Stellenbosch Univ.)

Arbitrage Arguments for Forward Contracts

An arbitrage opportunity is a trading strategy that costs nothing toenter, has a non–zero probability of making a profit, and a zeroprobability of making a loss.

We make the following assumptions:

1. Frictionless markets: This means

(i) No transaction costs;

(ii) No taxes (or else the same taxation rate for all investors);

(iii) No bid–ask spreads;(iv) No margin requirements;

(v) No restrictions on short sales;

(vi) Unlimited borrowing and lending at the same risk–free rate.

2. Absence of credit risk: There is no chance of investors defaulting on

any obligations.

3. Liquid and competitive markets: Investors can buy/sell an asset in

any quantity without affecting the price, i.e. they are price takers.

4. Arbitrage–free markets: Investors snap up any arbitrage opportunity

the moment it occurs.

P. Ouwehand (Stellenbosch Univ.)

Arbitrage Arguments for Forward Contracts

Consider a forward contract that requires payment of F in return foran asset S at time T . The current date is t and the current asset(spot) price is St.

We don't know what the price ST of the asset will be at time T .

Nevertheless, we will agree on the forward (delivery) price F .

I Suppose that the c.c risk–free interest rate is r .

I Consider now the following portfolio:

Cashflow at time t

Cashflow at time T

St er(T−t) − F

Note that final time–T value of the portfolio is already known at theinitial time t, i.e. there is no risk involved in holding on to thisportfolio.

I Since the portfolio has zero initial value, it should also have zero final

F (t, T ) = St er(T−t)

P. Ouwehand (Stellenbosch Univ.)

Arbitrage Arguments for Forward Contracts

Suppose that the forward price F is greater than Ster(T−t). In thatcase you can make a risk–free profit as follows:

I At time t, enter the short side of a forward contract, borrow St from

the bank and use this money to buy the asset. Your net cashflow is0 + St − St = 0.

I At time T you have the following: One forward contract obliging you

to deliver the asset ST for a price F , one asset ST (which you will useto honour your short position in the forward contract) and a debt ofSt er(T−t) owed to the bank.

I Since F > St er(T −t) you have made a net profit from an initial

investment of nothing!

This is called an arbitrage opportunity, and cannot exist for long.

Numerous investors will short a forward contract, borrow St from thebank, and buy the asset. The increased demand for the asset willincrease its price, until the arbitrage opportunity disappears, i.e. whenF (t, T ) = Ster(T−t).

Arbitrage is the force which keeps prices in equilibrium.

P. Ouwehand (Stellenbosch Univ.)

Valuation of Forward Contracts

The forward price of an asset S is calculated so that the initial valueof a forward contract (with delivery price equal to the forward price)is zero.

But this is only true initially: At maturity T , the value of the forwardcontract is ST − K to the party who is long, and K − ST to the partywho is short, and these numbers generally are not zero.

Over time, the asset price changes, and so does the forward price.

However the delivery price agreed upon in the forward contract doesnot change.

I If the forward price becomes greater than the delivery price, then

"long" has to pay less than the market–agreed fair price, so the forwardcontract has positive value to "long".

I Similarly, if the forward price moves below the delivery price, the

contract has negative value to "long", and positive value to "short".

P. Ouwehand (Stellenbosch Univ.)

Valuation of Forward Contracts

Valuing forward contracts is easy: Let St and F (t, T ) denote,respectively, the spot and forward prices of an asset S , where theforward price is for maturity T . Let K be the delivery price of aforward contract initiated at t = 0, i.e. K = F (0, T ).

I At a later time t, the forward price of the asset has changed to

F (t, T ), i.e. the fair price of S for delivery at time T is F (t, T ).

I However, the party who is long the original forward contract must pay

K , and not F (t, T ).

I This is a profit (or loss) of F (t, T ) − K at time T , and thus

(F (t, T ) − K )e−r(T −t) at time t.

I Hence the time–t value of the forward contract is

(F (t, T ) − K )e−r(T −t) to "long".

I With non-constant interest rates, the same argument would yield a

value of (F (t, T ) − K )B(t, T ) where B(t, T ) is the time –t value of azero coupon bond with face value 1.00 and maturity T .

P. Ouwehand (Stellenbosch Univ.)

Valuation of Forward Contracts

From another point of view: Suppose that at t = 0 you went long oneforward contract with maturity T and delivery price K . At time t,you can lock in a profit (or loss) of (F (t, T ) − K )B(t, T ) as follows:

I At time t short one forward contract with maturity T and delivery

price F (t, T ).

I At time T the contract you are long obliges you to pay K in return for

I The contract you are short requires you to pay ST in return for F (t, T ).

I Net cashflow at time T is therefore F (t, T ) − K . This is known at

I The time–t value of this is (F (t, T ) − K )B (t, T ).

P. Ouwehand (Stellenbosch Univ.)

An option gives the holder the right, but not the obligation to buy orsell an asset.

A European call option gives the holder the right to buy an asset S(the underlying) for an agreed amount K (the strike price or exerciseprice) on a specified future date T (maturity or expiry).

I The party who undertakes to deliver the asset is called the writer of the

I Because the holder of an option does not have to exercise the option,

the payoff to the holder is never negative. Thus the payoff to theholder is simply max{S (T ) − K , 0}.

I Since the payoff is never negative, options are not free. The premium

can be thought of as the price of the risk that spot price of theunderlying falls below K at maturity.

P. Ouwehand (Stellenbosch Univ.)

A European put option similarly confers the right to sell an asset foran agreed amount at a specified future date.

The holder of an American call (put) option has the right to buy(sell) an asset for an agreed amount. However, this right can beexercised at any time before maturity, and not just at maturity.

A call is in–the–money if S > K ; at–the–money if S ≈ K ;out–of–the–money if S < K .

P. Ouwehand (Stellenbosch Univ.)

Variables Affecting Option Prices

Intuitively, the value of an option is determined by

1. The probability that the option expires in–the–money;2. The expected payoff, given that the option expires in–the–money.

We isolate the following factors as important determinants of stockoption prices:

I Today's stock price S ;

I The strike price K ;

I The risk–free rate r ;

I The stock price volatility σ;

I The time to expiry T ;

I The rate at which dividends are expected to be paid.

Clearly call option values are an increasing function of S and adecreasing function of K .

Similarly, put values are a decreasing function of S and an increasingfunction of K .

P. Ouwehand (Stellenbosch Univ.)

Variables Affecting Option Prices

The effect of interest rates is trickier to see. Intuitively,

I If r increases, then the drift of the underlying is expected to increase as

I If r increases, then PV(K ) decreases.

Both these factors will cause the value of a call to go up, and thevalue of a put to go down.

The volatility of a stock price is a measure of the uncertainty of thefuture stock price. Thus the volatility is a fundamental determinantof the probability distribution of the future stock price. An increase involatility will tend to spread out the probability density, lowering itspeak, and fattening the tails.

If the stock price has greater volatility, then the option has a greaterchance of expiring deep in–the–money. Thus both calls and puts areincreasing functions of volatility.

P. Ouwehand (Stellenbosch Univ.)

Variables Affecting Option Prices

P. Ouwehand (Stellenbosch Univ.)

Variables Affecting Option Prices

P. Ouwehand (Stellenbosch Univ.)

Variables Affecting Option Prices

We can think of an option as a kind of insurance against rising (call)or falling (put) prices. Insurance for one year should cost less thaninsurance for two years. Thus we would expect that both calls andputs are increasing functions of the time to expiry.

Increasing Parameter

Effects of parameters on option values.

P. Ouwehand (Stellenbosch Univ.)

Arbitrage Bounds for Options

St = price of underlying asset at time t

r = risk-free interest rate (c.c.)

ct = value of European call option at time t

Ct = value of American call option at time t

pt = value of European put option at time t

Pt = value of American put option at time t

T = maturity of option

PVt(K ) = Ke−r(T−t)

Assumption: No dividends are paid during the life of the option.

P. Ouwehand (Stellenbosch Univ.)

Arbitrage Bounds for Options

0 ≤ ct ≤ Ct ≤ St

Options have limited liability: If its value were to turn negative, theholder would just discard the option. Hence ct ≥ 0.

The right to buy an asset cannot be worth more than actually havingthe asset. Hence Ct ≤ St.

An American option gives the holder all the rights of a Europeanholder, plus additional early exercise rights. More rights imply morevalue. Hence Ct ≥ ct.

P. Ouwehand (Stellenbosch Univ.)

Arbitrage Bounds for Options

0 ≤ pt ≤ Pt ≤ K .

The value of an american option at time t is ≥ the payoff if exercised attime t:

Proof: If the American option is exercised at time t, it will pay off

max{St − K , 0} ≥ St − K

Thus the value of the American call is at least St − K .

One should never exercise an american option if its value is > itspayoff. Why?

P. Ouwehand (Stellenbosch Univ.)

Put–Call Parity

For european options on a non–dividend paying asset:

Consider two portfolios:

(I) Buy a share and a put option with strike K .

(II) Buy a call with strike K and put PV (K ) in the bank

At maturity T , there are two possible states of the world:

Portfolio I pays off

P. Ouwehand (Stellenbosch Univ.)

Put–Call Parity

Portfolio II pays off

At maturity, the two portfolios have the same value in both states ofthe world.

By no–arbitrage (or the Law of One Price), the portfolios must havethe same value at all times before maturity.

Note that we did not make any assumptions about the futuredistribution of the asset price ST .

Alternatively:

I At expiry, a portfolio long a call and short a put pays off the same as a

forward contract with delivery price K .

I Thus this portfolio has the same value as a forward contract at all

times before expiry.

P. Ouwehand (Stellenbosch Univ.)

Arbitrage Bounds for Options

ct ≥ St − PVt(K ) and pt ≥ PVt(K ) − St

Proof: ct = pt + St − PV (K ) ≥ St − PV (K ), since pt ≥ 0.

P. Ouwehand (Stellenbosch Univ.)

Early Exercise of American Call Options

It is never optimal to exercise an American call (on a non–dividendpaying asset) before maturity.

Hence the price of a european call and an american call (on anon–dividend paying asset) coincide.

Suppose the American call is exercised at time t < T .

This realizes a cashflow of St − K . But

Ct ≥ ct ≥ St − PVt(K ) > St − K

since PVt(K ) = Ke−r(T−t) < K for t < T .

Thus the option value is greater than the payoff if it is exercised.

This means that the holder would have been better off selling theoption, instead of exercising it.

P. Ouwehand (Stellenbosch Univ.)

Early Exercise of American Call Options

There is no extra value in being allowed to exercise an American call(on a non–dividend paying asset) early — No rational investor woulddo this. There is therefore no early exercise premium, i.e. ct = Ct.

Qualitatively, there are two reasons why an American call should notbe exercised early:

(1) Insurance: Exercising early means foregoing the remaining period of

(2) Interest: Paying K early is worse than paying K later, because the

interest on K is lost.

For American put options:

(1) Insurance: Exercising early means foregoing the remaining period of

(2) Interest: Receiving K early is better than receiving K later.

Thus Insurance and Interest work in opposite directions for anAmerican put.

P. Ouwehand (Stellenbosch Univ.)

Early Exercise of American Put Options

It may be optimal to exercise an American put on a non–dividendpaying stock early if it is deep in the money.

P. Ouwehand (Stellenbosch Univ.)

Put–call inequalities for American Options

St − K ≤ Ct − Pt ≤ St − PVt(K )

Proof: : Exercise!

P. Ouwehand (Stellenbosch Univ.)

Limit Behaviour of Option Prices

ct, Ct are smooth increasing functions of St;

max{St − PVt(K ), 0} ≤ ct ≤ Ct ≤ St

ct, Ct → 0 as St → 0;

ct, Ct → St − PVt(K ) asympotically as St → ∞;

pt, Pt are smooth decreasing functions of St;

max{K − St, 0} ≤ Pt ≤ K ; 0 ≤ pt ≤ PVt(K );

pt → PVt(K ) and Pt → K as St → 0;

pt, Pt → 0 as St → ∞.

P. Ouwehand (Stellenbosch Univ.)

Call Option Price as Function of Stock Price

P. Ouwehand (Stellenbosch Univ.)

Option Prices as Function of Stock Price

P. Ouwehand (Stellenbosch Univ.)

Note that the American put value always lies on or above the final payoff.

For very low values of the stock price however, the European put value liesbelow the final payoff.

Option Pricing in a Single–Period Model

CAN WE PRICE THIS CALL OPTION?

P. Ouwehand (Stellenbosch Univ.)

Option Pricing in a Single–Period Model

We consider two approaches:

Pricing by Expectation: (Huygens–Bernoulli) The "fair" price is theexpected (discounted) payoff:

I So the price depends on p.

Supply and demand: The "correct" price is the one at which thesupply is equal to the demand.

I If demand goes up(down), so must the price: Higher prices will make it

more attractive to sell(buy).

I The higher the probability p of an ↑–move, the more attractive the

option, and thus the higher its price.

Both the above methods are WRONG!!

P. Ouwehand (Stellenbosch Univ.)

Option Pricing in a Single–Period Model

Consider a portfolio θ := (θ0, θ1) consisting of an θ0–many rands in abank account and θ1–many shares. At t = 0 the portfolio's value is

V0(θ) = θ0 + 10θ1

at t = T the portfolio's value is

We choose θ so that VT (θ) = CT , whether the stock price goes ↑ or↓:

1.1θ0 + 22θ1 = 11

P. Ouwehand (Stellenbosch Univ.)

Option Pricing in a Single–Period Model

As VT (θ) = CT no matter what, the Law of One Price dictates that

The probability p of an ↑–move is completely IRRELEVANT!!

The call option has been priced using an arbitrage argument.

P. Ouwehand (Stellenbosch Univ.)

Pricing by Expectation — Reprise!

Consider our first method for pricing the call option as (discounted)expected payoff (Huygens–Bernoulli):

This seems like a good idea, but it went horribly wrong:

I but we know that C0 = 3. 3 (or else there will be arbitrage).

However, the stock itself is not priced correctly via H-B.

I We ought to have

I Instead, we have S0 = 10.

We now find a probability p∗ for which H-B does price the stockcorrectly.

P. Ouwehand (Stellenbosch Univ.)

Pricing by Expectation — Reprise!

+ (1 − p∗) ×

If we use this new risk–neutral probability p∗ to price the option viaH-B, we obtain:

which is correct!!

Thus H-B yields the correct price, provided we use risk–neutralprobabilities.

P. Ouwehand (Stellenbosch Univ.)

The Fundamental Theorem of Mathematical Finance

A market–model is arbitrage–free if and only if there exists arisk–neutral probability measure.

Prices of derivative securities must be obtained via H-B, but usingrisk–neutral probabilities.

This theorem is easy to prove for this simple unrealistic model,

But it holds in general, for all models,

And makes it possible to numerically price options in very complicatedand realistic models, using Monte Carlo Simulation.

Example: Hedging an option on the S&P500.

P. Ouwehand (Stellenbosch Univ.)

Source: http://www.aims.ac.za/assets/files/AIMS_Finance_2014-1.pdf

The Use of Medication for People with Autism Spectrum Disorders Durham Conference 2004 Paul Shattock, Paul Whiteley, Autism Research Unit, School of Health, Natural and Social Sciences, Mitzi Waltz, School of Art, Design and Media, University of Sunderland, Sunderland, SR2 7EE "Charter of Rights for Persons with Autism (accepted as a written declaration by the European Parliament, May 6th 1996) No 18 THE RIGHT of people with autism to freedom from pharmacological abuse or misuse."

European Journal of Pharmacology 626 (2010) 139–145 Contents lists available at European Journal of Pharmacology Molecular and Cellular Pharmacology Inhibition of P-glycoprotein activity by limonin and other secondary metabolitesfrom Citrus species in human colon and leukaemia cell lines Mahmoud Zaki El-Readi Dalia Hamdan Nawal Farrag Assem El-Shazly Michael Wink a Institute of Pharmacy and Molecular Biotechnology, Heidelberg University, Im Neuenheimer Feld 364, 69120 Heidelberg, Germanyb Department of Pharmacognosy, Faculty of Pharmacy, Zagazig University, Zagazig 44519, Egypt