Cialis ist bekannt für seine lange Wirkdauer von bis zu 36 Stunden. Dadurch unterscheidet es sich deutlich von Viagra. Viele Schweizer vergleichen daher Preise und schauen nach Angeboten unter dem Begriff cialis generika schweiz, da Generika erschwinglicher sind.

Business.missouri.edu

Industry: Pharmaceuticals

RECOMMENDATION: HOLD

Johnson & Johnson is well positioned within the global

Closing Price $59.13 (6/21/10)

health care market. The company uses innovative products,

$66.20 (4/20/10)

robust pipelines and its talented people to capture a global

$54.91 (6/23/09)

presence in the health care industry. Johnson & Johnson is

committed to the future research and development of new

products. When necessary, the company is committed to

expansion via acquisition to improve its product development

Market Data

and global expansion. This will help sustain long-term growth,

and improve on company revenue, already projected to increase

by 5% in 2010. Johnson & Johnson's diverse selection of

products, in all three of its segments, gives the company

flexibility, and reduces risk for investors.

Valuation

Based on my evaluation of Johnson & Johnson and the

healthcare industry, it is my recommendation that we HOLD our

600 shares of Johnson & Johnson.

COMPANY PROFILE

Profitability & Effectiveness (ttm)

Johnson & Johnson is one of the largest and most

diversified health care firms in the world, with 250 operating

Profit Margin 21.26% Oper Margin

companies in over 60 countries. Johnson & Johnson, along with

Gross Margin 70.04%

its family of companies, is the largest medical device and

diagnostic company, the fourth largest biologics company, and

the eighth largest pharmaceutical company in the world. The

firm is divided into three major segments: Medical Devices and

Diagnostics, Pharmaceuticals, and Consumer Health Care.

Johnson & Johnson continuously seeks to expand its

global presence in the health care industry, while paving the

way for new product development. This past year, Johnson &

Johnson invested $7 billion (or 11.3% of sales) in research and

Jim Ludwig

development. This commitment to research is one internal

method that Johnson & Johnson uses to grow its pipeline of new

and innovative products. Johnson & Johnson also utilizes

company acquisitions to expand its market share and generate new growth. It is this method of combining innovative

products, robust pipelines, and talented employees along with a strong global presence that shapes Johnson & Johnson's business.

In 2009, worldwide sales decreased 2.9% to $61.9 billion, compared to increases in 2007

and 2008 of 14.6% and 4.3% respectively. Cash and equivalents at the end of 2009 were $15.8

billion, up from $10.8 billion at the end of 2008. Total borrowings increased to $14.5 billion at

the end of 2009, up from $11.9 billion at the end of 2008.

MEDICAL DEVICES AND DIAGNOSTICS

Johnson & Johnson's medical devices and diagnostics segment incorporates a wide range

of family companies, each producing a multitude of products. These products are primarily used in the health care industry by doctors, nurses, therapists, hospitals, laboratories and clinics. Product distribution in the segment is done by direct sales and through surgical supply.

Sales in the medical devices and diagnostics segment accounted for 38% of Johnson &

Johnson's total sales in 2009. The segment experienced growth of 1.9%, (consisting of a 4.2% operational increase and a 2.3% decline due to currency fluctuations), with 2009 sales totaling $23.6 billion. Additionally, U.S. sales were $11.0 billion, up 4.5% from 2008 and international sales were $12.6 billion, decreasing by 0.2% from 2008. Table 1 in the appendix highlights sales of the seven major franchises within the medical devices and diagnostics segment.

The segment experienced small or no gains in three of the seven major franchises,

including Cordis Corporation, Diabetes and Vision Care. This was due to increased competition for drug-eluting stents and tighter consumer spending on contact lenses and diabetes test strips. Conversely, the segment experienced high growth within the DuPuy, Ethicon, Ethicon Endo-Surgery, and Ortho-Clinical Diagnostics franchises.

New and innovative products within the medical devices and diagnostics segment have

helped to shape the landscape of the health care industry. CARTO 3, from Biosense Webster, Inc. gives doctors a detailed three-dimensional view of the heart to help treat cardiac arrhythmias (irregular heart rhythms). The SURGIFLO Hemostatic Matrix Kit is an advanced flow hemostat to be used in surgical procedures. Finally, the Vision Care franchise continued to prepare sales of the new 1 Day ACUVUE TruEye, the world's first daily disposable silicone hydrogel contact lens. On June 17, 2010, Johnson & Johnson announced the U.S. FDA's approval on the 1-Day ACUVUE TruEye, and will be available for eye care professionals later in June.

The segment continues to grow, and has recently expanded its product mix through

several recent acquisitions. Acclarent, Inc., specializing in designing and developing devices for the ear, nose and throat surgical space, was acquired in the first quarter of 2010. Finsbury Orthopedics, Ltd., specializing in hip implants, and Gloster Europe, a developer of innovative disinfection technologies, were also acquired in 2010.

Future growth will also be seen in the segment's continued dedication to strengthening its

pipeline of products. This includes products such as the SEDASYS System, the first computer-

assisted personalized sedation system, which received positive recommendations from the U.S. Food and Drug Administration in 2009.

Major Medical Devices and Diagnostics

Frannchise Sales - 2009 (in millions)

ETHICON ENDO-SURGERY

PHARMACEUTICALS

This segment of Johnson & Johnson consists of a family of companies that offer

medicines to help treat numerous diseases worldwide. Pharmaceutical products are centered on five major therapeutic areas: cardiovascular and metabolic diseases, immunology, infectious diseases, neuroscience, and oncology. Overall, the pharmaceutical segment represented 36% of Johnson & Johnson's total 2009 sales.

Pharmaceuticals accounted for sales of $22.5 billion in 2009, a decrease of 8.3% from

2008, with an operational decline of 6.1% and the remaining 2.2% due to the negative impact of currency fluctuations. Domestic sales totaled $13.0 billion, a decrease of 12.1%, while international sales totaled $9.5 billion, a decrease of 2.6%. Table 2 in the appendix highlights the major contributors to the Pharmaceutical segment over the past three years.

One major reason for the 2009 decline in sales was the loss of exclusivity for

RISPERDAL and TOPAMAX, representing a loss of nearly $3 billion in sales. Competition from generic drug producers will continue to put pressure on this segment, and increase demand

for future innovation. In response, Johnson & Johnson invested $4.6 billion in pharmaceutical research in 2009.

Conversely, Johnson & Johnson's broad spectrum of products, treating a wide range of

diseases, will give the segment flexibility and growth opportunities in the future. The largest 2009 revenues came from products treating diseases such as inflammatory diseases (REMICADE), attention deficit hyperactivity disorder (CONCERTA), schizophrenia (CONSTA), and HIV (PREZISTA).

The pharmaceutical pipeline of new and developing products is seen as a major strength

of Johnson & Johnson. The segment launched five new drugs in 2009, including SIMPONI and STELARA (immunology), NUCYNTA (immediate release tablets for pain relief), INVEGA SUSTENNA (schizophrenia), and PRILIGY (sexual health). Up and coming products in Phase III clinical trials include treatments for diabetes, prostate cancer, and Alzheimer's disease. The segment has historically devoted research into broadening drugs individually, as seen in REMICADE, which now has 15 FDA-approved indications for use in various immune system disorders.

Johnson & Johnson has also expanded its pharmaceutical segment outward, acquiring or

signing innovative agreements with companies in various medical arenas. Elan Corporation, plc works in slowing the progression of Alzheimer's disease. Crucell NV works with a monoclonal antibody product for the treatment and prevention of influenza. Gilead Sciences, Inc. developed an HIV therapy with a single combination pill. Finally, Cougar Biotechnology, Inc. works in the treatment of prostate cancer.

In addition to domestic research and product launch, the segment has expanded

internationally, focusing on emerging markets. The segment has now expanded its sales reach in China, its manufacturing in China, Mexico and Brazil, and its R&D presence in India and China.

Major Pharmaceutical Product Revenues

- 2009 (in millions)

Other Pharmacuticals

CONSUMER HEALTH CARE

Most of Johnson & Johnson's Consumer products are well known throughout the United

States, and are used by over a billion people worldwide. This segment includes products located within baby care, skin care, oral care, wound care, and women's healthcare areas. Johnson & Johnson's consumer segment distribution brings products to both healthcare professionals and consumers in a direct approach. The consumer segment of Johnson & Johnson accounted for 26% of the company's 2009 sales.

Consumer segment sales in 2009 were $15.8 billion, a decrease from 2008 by 1.6%, with

2.0% growth operationally and a negative currency impact of 3.6%. The U.S. consumer segment accounted for $6.8 billion, a decrease of 1.4%. International sales were $9.0 billion, a decrease of 1.7% (this includes 4.7% operational growth and a negative currency impact of 6.4%). Table 3 in the appendix highlights the top performers in the consumer segment for 2009.

Over-the-Counter (OTC) Pharmaceuticals and Nutritionals franchise sales were $5.6

billion, a decrease of 4.5% from 2008. Major brands within this sub-category include ZYRTEC, SPLENDA, TYLENOL, SUDAFED, and PEPCID AC. In 2009, SPLENDA experienced strong growth, while inventory buildup negatively affected sales of ZYRTEC.

In their annual report, Johnson & Johnson acknowledged the U.S. FDA looking into the

potential for overdose with acetaminophen, the active ingredient in TYLENOL brand products. In December 2009, the company announced a voluntary recall of all lots of TYLENOL Arthritis Pain 100 due to an uncharacteristic smell. In January 2010, the company undertook a broader recall of TYLENOL as a precautionary action. On June 15, 2010, Johnson & Johnson announced an expansion of the January recall. This included four lots of Benadryl Allergy Ultra tablets and one lot of Extra Strength Tylenol. The products under a recall were distributed in the U.S., Puerto Rico, Bermuda and Tobago. It is now known that odor associated with the recall came from a chemical used to treat wooden pallets that transport and store medication packaging materials. The Skin Care franchise sales grew by 2.5% to $3.5 billion in 2009. This growth was primarily associated with strong sales in the AVEENO, NUTROGENA, and DABAO skin care lines. The Baby Care franchise reported sales of $2.1 billion, a decrease of 4.5% from 2008 primarily attributed to the exiting of the online retail business, Babycenter.com. The Women's Health franchise sales were $1.9 billion, a decrease of 0.8% from last year. The Oral Care franchise saw sales of $1.6 billion, a decrease of 3.4% from 2008. Finally, the Wound Care/Other franchise sales grew by 9.4% to $1.1 billion due to the acquisitions of the Wellness and Prevention platform and strong sales of PURELL hand sanitizer.

Johnson & Johnson acknowledges that more than half of Consumer sales come from

markets outside the United States. The company has attempted to capture this expansion in emerging markets such as Mumbai, India, where Johnson & Johnson opened its first NEUTROGENA store. They have expanded Skin iD, an online personalized acne solution sold direct to consumers, as well as home shopping networks.

Major Consumer Franchise Sales - 2009

OTC Pharmaceuticals &

INDUSTRY OUTLOOK

In the summer 2010 Investment Fund Management Economics Report, the team

highlights an overarching feeling of uncertainty within the Healthcare industry. This is primarily due to the recent passing of President Obama's healthcare reform bill in early 2010. Industry experts see potential problems within the industry over the short term, due to new tax laws and reform stemming from the healthcare bill. Medicare and Medicaid changes might also hurt health care companies in the short run due to increased rebates and discounts on pharmaceuticals. However, some analysts point to potential long-term growth coming from the bill due to increased sales and use of medical equipment. The aging population of "Baby Boomers" could also have a positive effect, as that generation could require more medical procedures in the future.

Johnson & Johnson is clearly aware of the changing landscape, and addresses this point

in their 2010 Annual Report. William C. Weldon, Chairman and CEO, notes that Johnson & Johnson "supports reform that expands access to care, improves the long-term sustainability of the U.S. health care system and builds on the best aspects, including incentives for medical progress." The company also is confident that a proper mix between increased patient care and growth opportunities for health care companies can exist. Mr. Weldon goes further, saying Johnson & Johnson "is well positioned for a changing landscape."

Eli Lilly

Novartis Pfizer

Market Cap

(B)

Div Yield

Profit Margin

Debt/Equity

Revenue (M)

POSITIVE FORCES FOR GROWTH

Global Presence

Part of Johnson & Johnson's global reach includes expansion in high-growth and

emerging markets such as the BRIC counties. Johnson & Johnson is fully committed to the expansion of health care across the world, and as an industry leader, remains flexible to incorporate different strategies in different markets.

In February 2008, Johnson & Johnson partnered with the Russian government to build

and establish the Russian Center for Professional Education. Since its opening, 3,000 physicians have been trained at the center, and the number of high technology interventions in the past two years has increased from 8,000 to 19,000. Not only does this set the foundation for Johnson & Johnson in an emerging market, but it also helps to streamline patient care and reduce invasive surgeries. Johnson & Johnson has more than 25 professional education centers around the world. For the Medical Devices and Diagnostics business, the centers also create innovative partnerships with governments across the world. Other locations include Brazil, Germany, India, France, China and Japan.

Johnson & Johnson expects the global health care market to grow by 5% over the next

five years. International sales in 2009 were $31.0 billion, following sales of $31.4 billion and

$28.7 billion in 2008 and 2007 respectively.

Research & Development/Strong Pipelines

Staying flexible within a changing domestic and international business climate is

essential for Johnson & Johnson, whose products mirror the needs of the global community. Johnson & Johnson uses a commitment to R&D, as well as robust pipelines of new products to stay ahead of competition. New products that were introduced over the past five years accounted for 25% of the company's 2009 sales. Last year, Johnson & Johnson continued the trend by spending $7 billion in R&D. This product development will help Johnson & Johnson stay ahead of generic drug makers who could gain market share as drug patents begin to expire. This flexibility will also play well in dealing with any industry changes that come of the new healthcare reform.

Diverse Product Mix

Johnson & Johnson's product diversification helps capture a larger market share, and

tailor products to consumer's needs. The company is split into three major segments including

drugs, medical devices and consumer goods. Company diversification comes in the form of

internal innovation, as mentioned above, and also external acquisitions when necessary. Since

early 2008, Johnson & Johnson has made eight major acquisitions and invested in several

strategic transitions. This allows Johnson & Johnson to reduce costs and focus on the customer,

allowing for sustained growth. Because of this diversification some analysts see Johnson &

Johnson as a low risk stock, and largely immune to economic cycles.

NEGATIVE FORCES FOR GROWTH

Recalls/Lawsuits

Any major company will face adversity in the form of legal action; however, Johnson &

Johnson has faced recent recalls that have raised questions. Beginning in December 2009,

Johnson & Johnson began to initiate voluntary recalls of TYLENOL brand products due to an

uncharacteristic smell. This recall has carried over into the current year, and in June 2010,

Johnson & Johnson announced further recalls. Many experts are questioning the recall delay and

the length of time it took to identify all the problem areas. The U.S. FDA is still involved, and

time will tell if consumer sentiment will be affected by the recalls.

Patent Expiration/Intellectual Property Rights

Johnson & Johnson operates in an environment that has become increasingly hostile to

patent competition and intellectual property rights. Generic drug makers are now poised to

expand on expiring product patents for many healthcare leaders. In some cases, generic drug

firms have filed Abbreviated New Drug Applications (ANDAs), seeking to market generic forms

of Johnson & Johnson's products prior to patent expiration. Johnson & Johnson is continually

fighting legal battles over these property rights. If unsuccessful, Johnson & Johnson could stand

to lose substantial market share and revenue. Johnson & Johnson currently has eight product

lawsuits pending against generic drug makers. On June 21, 2010, Business Wire announced a

$1.67 billion verdict won by Jonson & Johnson in the dispute against drug maker Abbott

Laboratories over Abbott's arthritis drug Humira.

Health Care Reform/Reductions

For Johnson & Johnson, the new health care reform bill brings uncertainty to business

operations and the overall industry. Medicare and Medicaid tax credits and discounts will financially affect health care firms such as Johnson & Johnson in the future. Although Johnson & Johnson acknowledge this future industry change, industry experts have adjusted earnings per share estimates due to the reform. Standard & Poor's expect a projected $0.10 a share hit from the reform. Perhaps a secondary effect of the reform is seen in the form of cost cutting. Johnson & Johnson announced in November 2009 a restructuring of the company, including the elimination of 7,500 positions.

STOCK PERFORMANCE

1 Year Stock Performance vs. S&P 500

5 Year Stock Performance vs. S&P 500

DIVIDEND

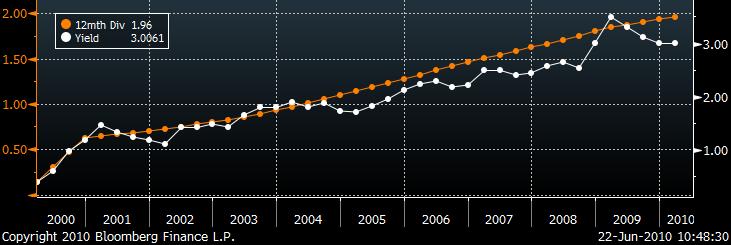

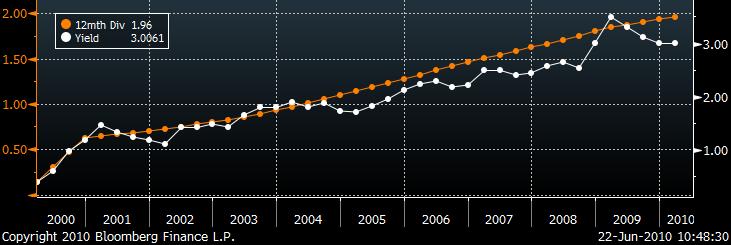

In 2009, Johnson & Johnson increased its dividend for the 47th consecutive year, and paid

a total of $5.3 billion in dividends to shareholders. Johnson & Johnson's 2009 dividend was $1.930 per share, up from $1.620 per share in 2007 and $1.795 per share in 2008. Bloomberg highlights this history in the following chart listing dividend and yield data from 2000-2010.

VALUATION

To calculate a reasonable estimate of Johnson & Johnson's intrinsic value, I used the

Owners' Earnings Model. To calculate CAPM, I found Bloomberg's 10 year raw beta estimate of Johnson & Johnson to equal 0.481. Using the risk free rate of 3% and an expected market return of 11%, the discount rate is calculated:

K = .03+0.481(.08) = 6.848%

In Johnson & Johnson's five year financial summary, the company reports worldwide growth rates from 2004-2009 (5 yr.) and 1999-2009 (10 yr.) of 5.5% and 8.5% respectfully. In my valuation, I chose to use a conservative rate of 5% for first stage growth and 3% for second stage growth. My reasoning is that the past five years (2004-2009) are a better indicator of future growth based on the current health care environment. Further, I wanted to take into account any future uncertainty with the health care reform as well as competition from generic drug makers in the industry.

The Owners' Earnings Model reports an intrinsic value of $145.94. At the end of the

trading day, Monday, June 21, 2010, Johnson & Johnson was priced at $59.13. This is a significant disparity in prices, and therefore shows Johnson & Johnson to be undervalued at its current price.

SELECTED FINANCIAL INFORMATION

SOURCES USED

JNJ.com

CNBC.com

S&P Net Advantage

Dow Jones Factiva

Summer 2010 Investment Fund Management Economics Report

Big charts.com

SEC.gov/edgar

Source: https://business.missouri.edu/ifmprogram/reports/2010SP/J&J%20Report.pdf

Nuclear Receptor Resource The Retinoic Acids Receptors P.P. Albrecht, J.P. Vanden Heuvel, INDIGO Biosciences Inc., State College PA Retinoic Acid Receptors 1 Overview Retinoic acid receptors (RAR) are nuclear receptors from ‘Thyroid hormone receptor-like family' that mediate the effects of retinoids (compounds such as

NEW PATIENT REGISTRATION Contact Information Patient Name (Last, First, MI): Primary Care Physician: How did you learn about our practice? O Referred by a Physician: O Internet / Website O Newspaper / Magazine O Referred by a Patient: Demographic Information Social Security #: - - Gender: O Male O Female O Other O Co-Habitating O Married